In this past weekend I stated

“While my “emotions” are currently screaming to start increasing equity allocations at this juncture, there are several reasons why my discipline is keeping me from doing so currently:

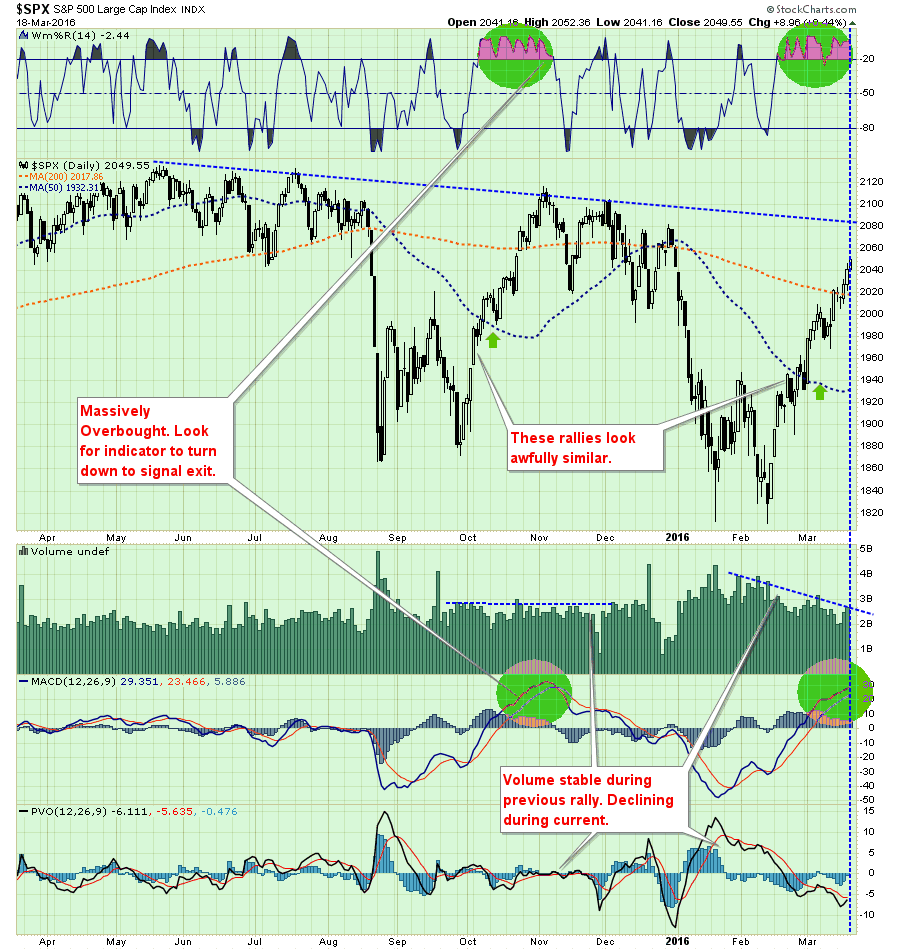

- The market is GROSSLY overbought in the short-term and will have either a mild corrective process or consolidation to allow for an increase in equity exposure.

- Negative trends are still in place which suggests the current rally, while significant, remains within the context of a reflexive rally.

- Volume is declining on the rally suggesting a lack of conviction.

- This rally looks very similar to the rally last October except the fundamentals are substantially weaker.”

While I have maintained a cautious stance in portfolio allocations since May of last year, I have reiterated many times that interventions by Central Banks could change the shorter-term dynamic of the markets from bearish back to bullish. These past few weeks have seen exactly that occur.

The question that we must primarily answer is whether enough “technical repair” has been completed to warrant an increase in equity exposure in portfolios. As stated above, the “risk” that the current “bear market” rally is nearer completion outweighs the possibility currently the markets are changing back to a “bull market.” Therefore, it is more prudent, for long-term investors, to remain cautious for now.

Only 4% From All-Time Highs

Yesterday, while I was at the gym I looked up to see a “talking head” on CNBC stating the markets are only 4% off of their all-time highs. He was making the case, of course, that the “bull market was back” and the recent sell-off was a“buy the dip” opportunity. But is that really the case? Of course, we will never know for certain until we have the clarity of hindsight. However, since we can’t invest with hindsight we must make some assumptions, or should I say“guesses” about what will happen in the weeks and months ahead.

Leave A Comment