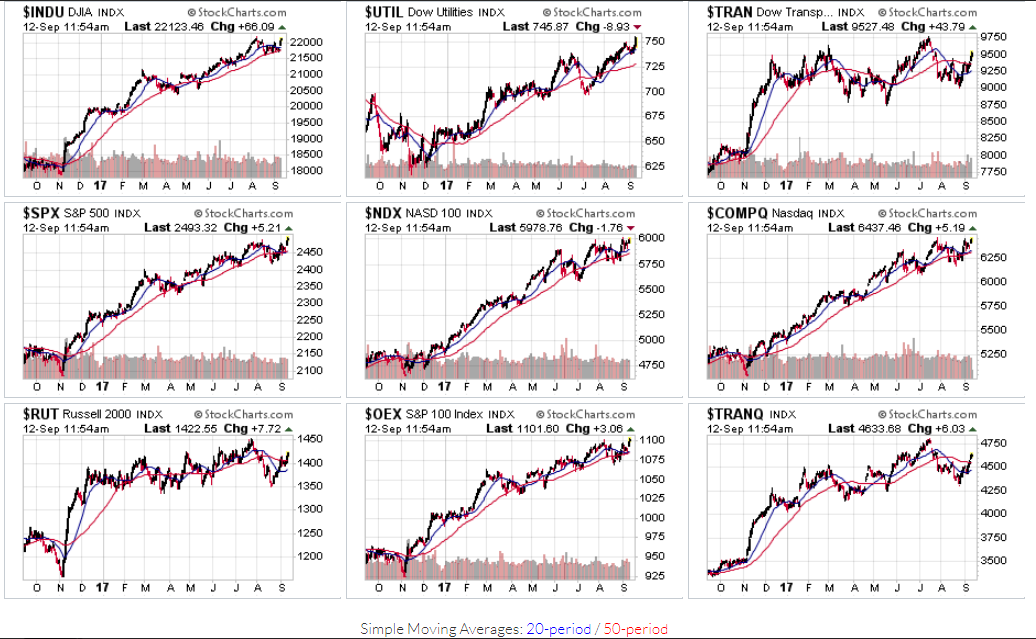

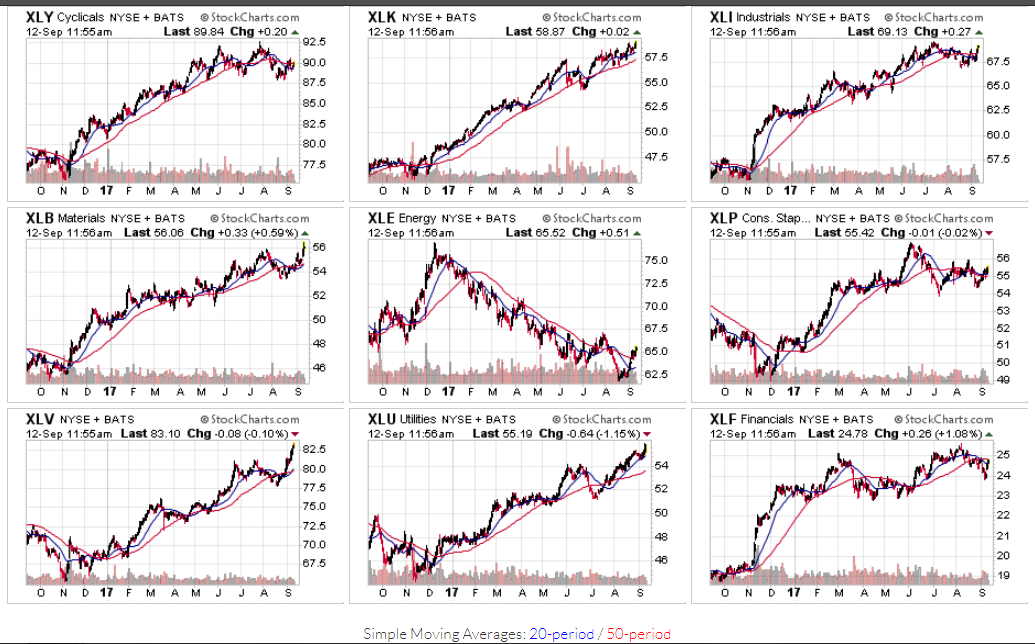

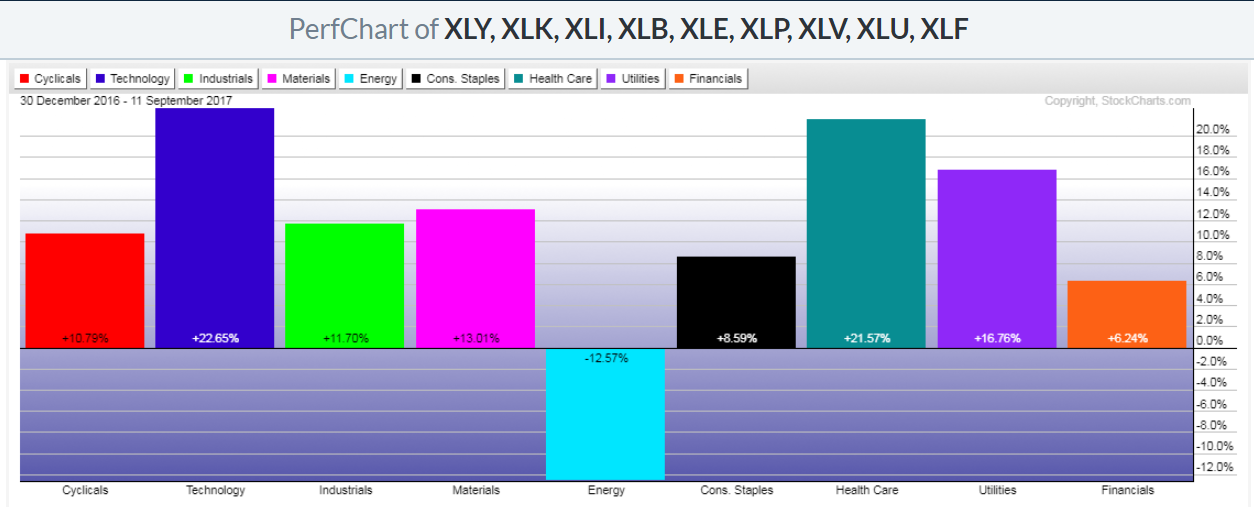

It’s all about the Technology and Healthcare sectors this year, in terms of gains made, so far, as shown on the following 1-year charts and year-to-date graphs of the Major Indices and 9 Major Sectors.

The laggard, Energy, may be poised for a recovery if it can hold above its down-trending 50-day moving average.

The Materials sector is on the verge of a new breakout. Keep an eye on GOLD and Gold Miners ETF, as I’ve recently described here and here.

The Russell 2000 Index is still mired in a large-scale sideways consolidation zone…watch for any breakout (and sustained hold) above this zone as a potential signal of renewed and serious riskier asset-buying in the markets, in general

Traders may be influenced by the upcoming interest rate decision and press conference by the Fed on September 20, so these indices and ETFs may drift until then. If the Fed hikes rates, watch for any renewed and serious buying in the Financial sector (see my latest article on XLF here), as well as a sustained breakout and hold above its 50-day moving average and large sideways consolidation zone. And, furthermore, just a final comment on currencies in this regard…watch for any renewed buying in the U.S. Dollar, which has been battered this year, leading up to and following the Fed meeting, in anticipation, potentially, of a rate hike…we may see it retest the 50-day moving average before it, either, renews its downtrend, or continues a rally.

Leave A Comment