Indicators

Sectors to Watch Today

Technology started the day in the lead, but quickly gave up all of its gains on the day to be the second worst performer, behind Energy. Fifth straight weakness for the sector. Industrials also feeling the weight of weakness in Boeing (BA). Financials show some relative strength yesterday, and may be attempting a bottom pattern here.

My Market Sentiment

Yesterday saw a sell-off from highs to lows of 103 points on SPX. That is truly incredible, and led in large part by the market’s most dependable leaders of the past year – namely AMZN and BA. These two stocks, while weak again this morning, will have to kick it in high gear, in order to leave the markets once again.

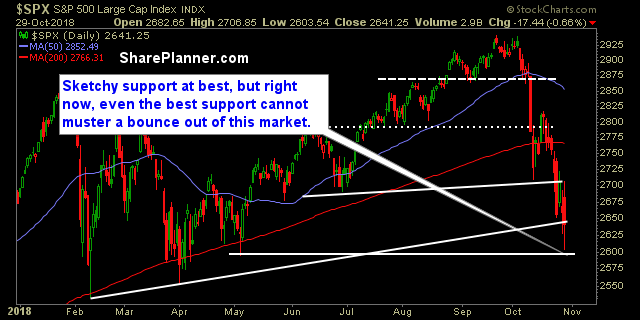

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment