TSLA Has A Terrible Weekend

There are many acronyms to describe the large momentum tech names. One of those is TFAANG. That one includes AMZN and TSLA. While there weren’t any earnings reports during the holiday weekend, there were prominent tweets from Elon Musk and President Trump which affected stocks. Tesla’s CEO jokingly tweeted that Tesla was going bankrupt as an April fools day joke. Normally, this would be odd, but in the current situation, it makes Elon Musk look deeply out of touch with reality. On Sunday, the National Transportation and Safety Board announced Tesla mishandled the investigation into the car crash which was caused by Tesla’s autopilot. The company brushed it aside unlike Uber which took its crash much more seriously and suspended the self-driving tests.

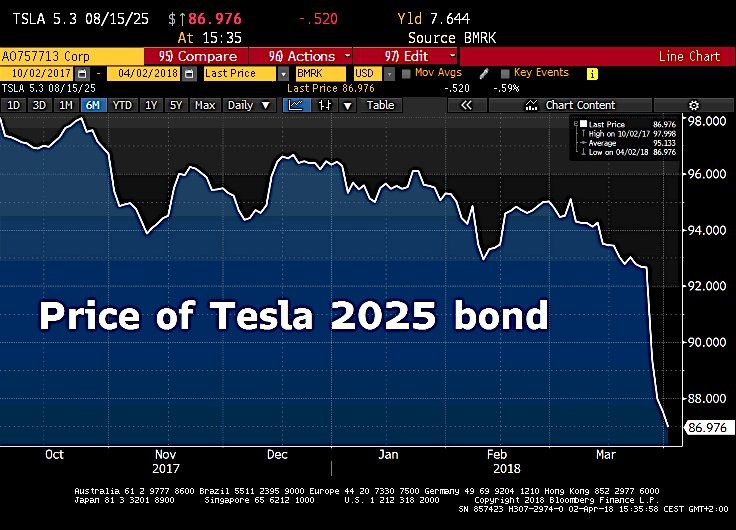

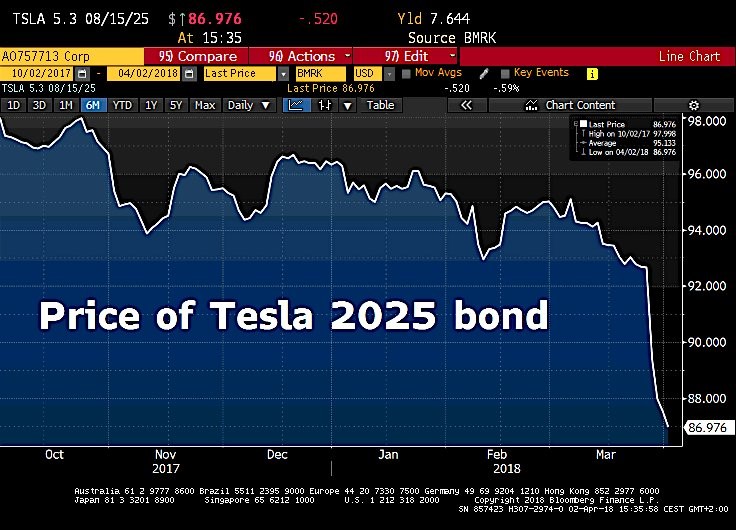

There’s nothing wrong with an April fools joke. In fact, Elon Musk’s ability to maintain a high public approval rating through his use of social media helps Tesla sell cars. His 21 million Twitter followers are a huge asset to the company. The major problem with that asset is it’s difficult to maintain. It’s easy to offend people. Musk’s joke was far too close to reality given Tesla’s recent bond price action. As you can see from the chart above, Tesla’s 2025 bonds are collapsing. This will hinder its ability to issue new debt which is a huge problem because it will likely need money in the next 12 months. Getting shut out of the public market because there’s no investor demand for Tesla’s debt can be a self-fulfilling process which eventually causes the firm to spiral out of control.

The stock cratered 5% on Monday. It has now dropped 34% from the September high. That makes it more difficult to sell equity. While Elon Musk jokingly tweets about the collapse of his company, the firm is about to report how many Model 3 cars were produced. The weekly run rate is supposed to be 2,500. However, as you can see from Bloomberg’s estimate below, the firm is only producing 1,190 per week which is half the guidance. Tesla is widely held by retail investors. I view it as a sign of sentiment and an indicator for where we’re at in the business cycle. The fundamentals are weak. When Tesla faces trouble, it means financial conditions are probably stressed.

Leave A Comment