First, the good news.

Despite all of the volatility over the last two months, a seemingly brutal quarter for investors came to an end with a staggering loss on the S&P 500 of -1.22% or about -0.76% including dividends.

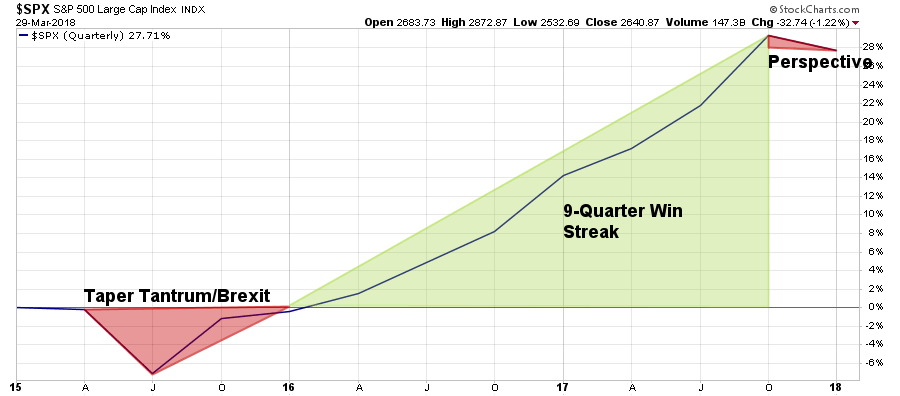

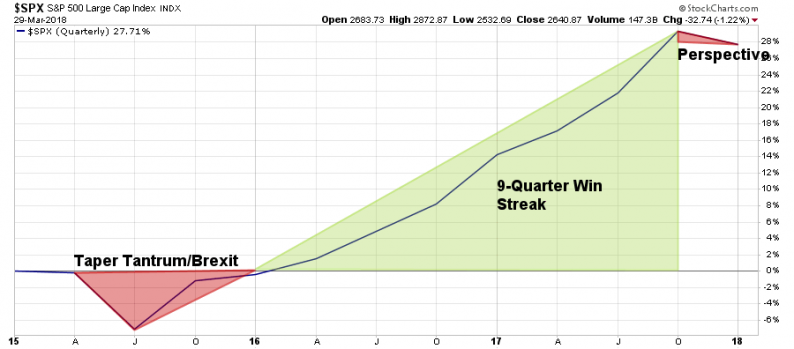

I know, it’s horrible. After all, the S&P 500 just broke a 9-quarter straight winning streak which was one of the longest in history. For some perspective, the chart below shows the quarterly performance from 2015 to present.

When you look at it this way, there doesn’t seem much to worry about.

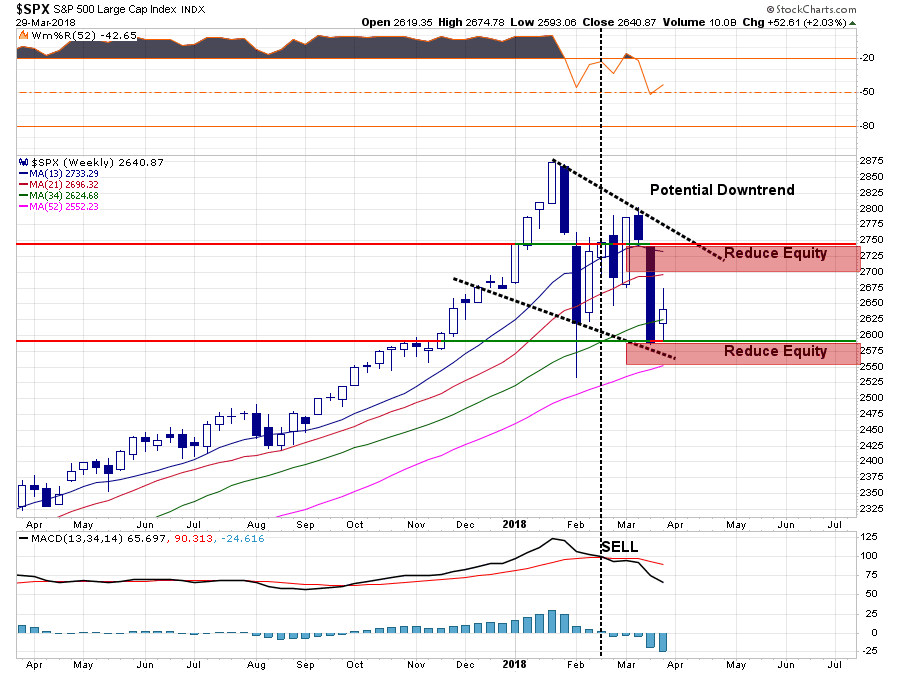

However, as I have been discussing over the last two months, once you zoom into the ongoing consolidation process the picture changes more dramatically.As I noted on Tuesday:

“With the market oversold, we are looking for a rally to the 100-dma to further rebalance portfolio risks. (We have been doing this already over the last several weeks and have been underweight equity and overweight cash.)”

Chart updated through Thursday’s close:

“However, my guess is we are not likely done with this correctionary process as of yet.”

It is this pickup in volatility where the majority of emotional, or behavioral, mistakes are made.

From a very short-term perspective the backdrop has improved to support a continued reflexive rally next week:

With this setup, the possibility of more constructive action next week has risen.

Of course, there are a lot of things that could go wrong as well, so having a plan remains key.

While we had reduced allocations to basic materials, industrials, international and emerging markets a few weeks ago, when the current Administration launched their “tariff” related plans,we also have removed our “short hedges” for the time being to allow for this reflexive rally to occur.

Given the more constructive backdrop, we are maintaining the balance of our equity exposure for now and have NOT reduced allocations to the new adjusted target levels as of yet. As discussed last week:

“This week, the markets broke on several fronts which have triggered confirmed ‘sell signals’ on several levels requiring a reduction in equity risk exposure. In accordance with the model adjustments above, begin reducing portfolio equity weighting by 25% on any failed rally attempts.”

“IMPORTANTLY – this does NOT mean go ‘sell’ everything Monday morning. As noted above in the main analysis, we are slightly reducing equity exposure on a rally to hedge risks of a further decline until the current volatility phase passes.

Importantly, as always, portfolio management is about making SMALL adjustments as evidence presents itself and should never be perceived as an ‘all or nothing’ issue. “

We have NOT made that adjustment yet as our target levels for a retracement have not been fulfilled, nor has support been broken.

An occurrence of either event, as shown below, will lead to further reductions in portfolio “risk.”

Is A Bear Emerging?

The bigger question, however, is whether, or not, the 9-year old bull market is coming to an end?

Let me clarify something first.

I am neither bullish or bearish. I just look at the markets a “tad” differently than most.

While portfolios allocations remain “nearly” fully invested, (we are carrying about 12% cash currently,) the longer-term market trend remains clearly upward which keeps us more allocated to equities currently.

Here is the important point.

When portfolios are allocated to the markets, and the markets are rising, I am not really concerned about finding reasons why the market will “continue to go up.”

My bigger concern, as it both destroys capital and impairs performance, is what are the risks of a sudden and unanticipated correction. Kind of like the one we are experiencing now.

When the next major correction occurs, my focus will change on what could “end” the bear market and cause the markets to rise.

The goal of investing for the long-term, after all, is to “buy low and sell high,” not vice-versa.

“If you only focus on the half of the full-market cycle you want, you will miss the signs warning you of the half you don’t.”

For me, a “bear market” is not a correction of 20%, or worse, but rather a period of time where the risk to capital is substantially greater than reward. In my view, a correctional process that spans several months with substantially higher volatility and capital risk is qualifying of the “bear market” label. Waiting until you have a 20% decline before deciding to take action is really rather pointless.

Leave A Comment