The rest of the FANGs may be crashing and burning, but one “story stock” refuses to give up: Netflix (NFLX).

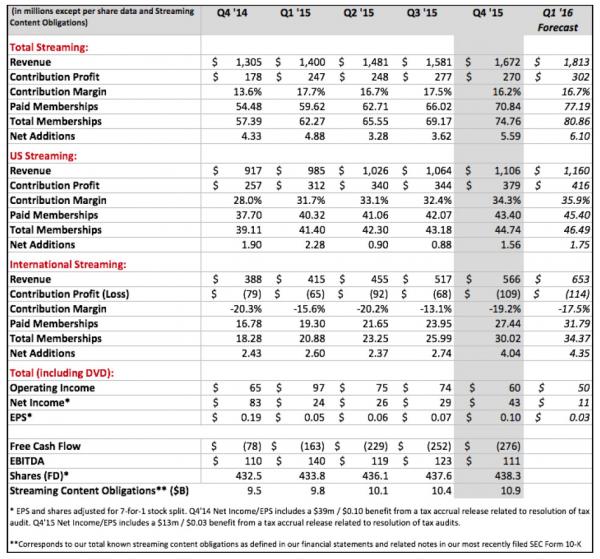

Reed Hastings ubiquitous streamer of videos right into your bedroom reported Q4 EPS of $0.10 (vs the $0.08 expected), on $1.82BN in revenue, a fractional miss to expectations, however as everyone “knows”, Netflix does not trade on fundamentals.

What does it trade on?

Well, the story is simple: all about “eyeballs” or in this case, subscriber data, and here it gets a little dicey, because while NFLX reported a miss in net domestic adds which at 1.56 million were just fractionally lower than the 1.62 million expected, and perhaps more troubling: Q4 US net adds were down year over year, 1.56m actual versus 1.90m prior year.But it was the surge in low-margin, high cost international subs that saved the day: at 4.04 million, this number was far above the 3.5 million expected.

Additionally, as part of NFLX’ guidance, while the domestic growth appears to be tapering, with the company expecting 1.75MM net adds in Q1 2016, down from the 2.28MM a year ago, it predicts a surge in international net streaming subs, which should grow by 1.75MM from a year ago to 4.35MM.

Some more findings: Q4 total streaming contribution margin of 16.2% declined to the lowest in 2015 driven by the drop in the international streaming loss, which at ($109) million, was a -19.2% profit margin, versus the 34.3% domestic profit margin.

In other words, while NFLX domestic growth appears to be trailing off, this will be the cash flow basis which the company will use to grow internationally, even if so far at least the profit contribution from offshore is wildly negative.

And a little more to the “story” from the letter:

Leave A Comment