While I remain long and invested in the markets on behalf of my clients, I focus and write about the significant risks that are currently present. I am fully aware a laissez-faire attitude towards these risks is ultimately likely to destroy large portions of my clients hard-earned, and irreplaceable, investment capital.

Note: Myself, and everyone that writes for Real Investment Advice, do so under our actual name. We pride ourselves on our transparency, and our responsibility, to all that read our work. We value our loyal following and work diligently to improve upon the original ideas and research we share.

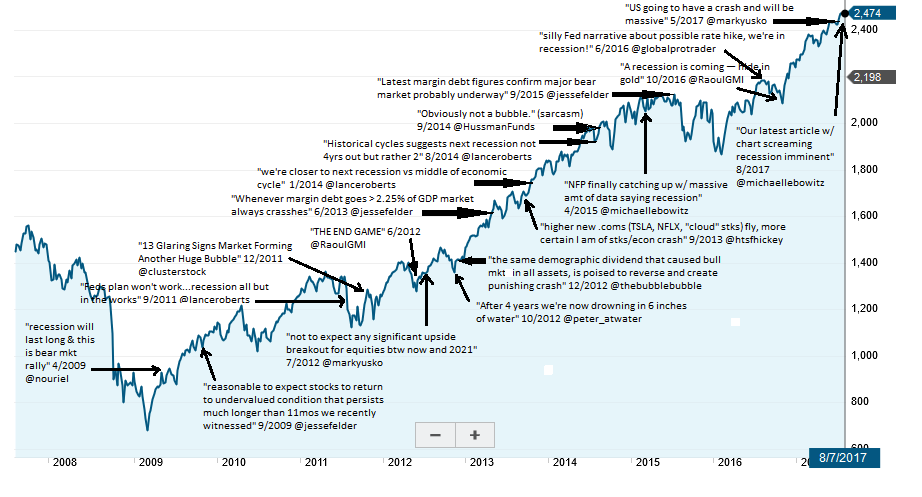

This past week, I was treated to a chart from “The Fat Pitch” blog, by Urban Carmel, which took several pieces of my previous writings out of context to try and suggest that I somehow had “missed the market.”

“Yet, throughout this period, investors with even a passing interest in financial news have regularly seen commentary from experienced managers that the stock market is highly likely to plunge now. The irony of equity investing is this: if you knew nothing about the stock market and did not follow any financial news, you have probably made a very handsome return on your investment, but if you tried to be a little bit smarter and read any commentary from experienced managers, you probably performed poorly.”

While I certainly appreciate the “buy and hold” crowd trying to justify why you should just take a blind approach and hold on for the ride, I struggle because I am all too aware when market shifts occur, as proven in 2000 and 2008, years of gains can be wiped out in months.

By taking commentary out of context from the managers noted above, it misses the actual investment management process being undertaken by myself as well as some of the other individuals listed. What he left off the chart above from myself are prescient market calls such as:

- December 2007: “We are, or are about to be, in the worst recession since the ‘Great Depression.’”

- February 2009: “Here are 8-reasons for a bull market.”

- March 2012: “Coming This Fall, The Best Time To Invest”

- March 2013: “Time to get out of Gold.”

- June 2013: “Pimco says bond bull market is over, I say it is still alive”

- April 2014: “Time to get out of Energy.”

- August 2015: “Why This Time Could Be Different” (Warned of the coming 2015-16 correction)

- October 2016: Technically Speaking: 2400 or Bust

You get the idea.

And yes, as noted in the chart above, I did warn about things that didn’t come to pass, such as the correction in 2015-2016 was only a 20% decline, and despite plenty of economic evidence which suggests it was a “mini-recession,” it was never officially labeled that way…yet.

Leave A Comment