Written by Norman Carter

Spill-Over Effects and Contagion

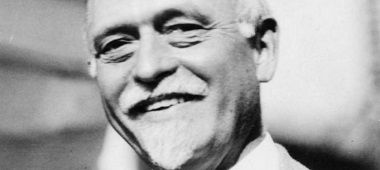

In 1933, during the depths of the Great Depression, famed economist Irving Fisher wrote a work that became a classic of economics and is still widely read and cited today. The book was titled The Debt-Deflation Theory of Great Depressions.

Fisher was the most famous U.S. economist of the first half of the 20th century and made many intellectual contributions to economics, including work on monetary policy and equilibrium analysis that led to later contributions by contemporary economists including Milton Friedman and Ben Bernanke.

Yet Fisher’s work on debt and deflation is his best-known and most important effort. Most applauded. His thesis was straightforward. Depressions are the inevitable aftermath of credit booms and extreme over-indebtedness.

During the expansion phase of a cycle, easy credit allows debtors to bid up asset prices. The higher asset prices then serve as collateral for further debt, which is used to invest in other assets, causing those prices to rise also. At some stage, valuations become stretched.

Creditors refuse to extend more credit and demand repayment or require more collateral from the debtors. At this point, the entire process goes rapidly into reverse. Now debtors have to sell assets to repay creditors. This forced selling causes asset prices to drop. The lower asset prices reduce the collateral values on other loans, which cause those loans to be called by the creditors also.

Now the forced liquidation of assets becomes widespread, businesses fail, layoffs increase, unemployed workers cannot afford to spend, more businesses fail as a result and so on until the entire economy is thrown into recession or, even worse, full depressions.

This process played out in the period 1929 – 1933, and again from 2007 – 2009. The latest episode is usually known as the Great Recession, but is more accurately called the New Depression. It is still with us in the form of below-trend growth, threats of deflation and low labor force participation. This new episode has led to a revival of interest in Fisher’s theory.

The Perfect Storm 101

Investors today can see Fisher’s thesis at work in the field of shale oil production. From 2009 – 2014, several trillion dollars of debt was issued to support shale oil exploration and drilling using a method called hydraulic fracturing, or “fracking.”

Leave A Comment