My Swing Trading Approach

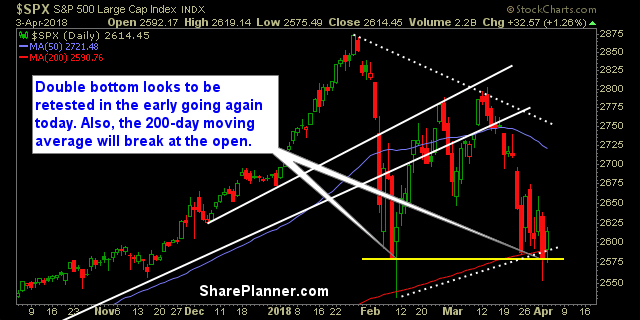

With the large gap down this morning, the market is in dangerous territory, and risks breaking Monday’s lows and eventually the February intraday lows. As a result, I will stay put in my trading, until the market has provided me with a more definite trading edge to work with.

Indicators

Industries to Watch Today

Energy, Industrials and Healthcare led the market bounce yesterday, while Utilities lagged. Energy showing the potential still for a base breakout, while Healthcare is exhibiting a double bottom similar to that of the S&P 500. Technology while having been hammered over the past month, is still one of the best long-term charts.

My Market Sentiment

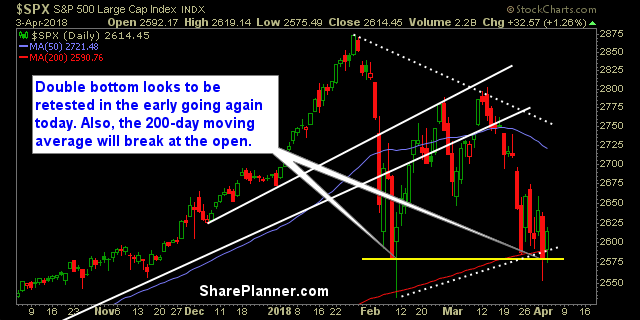

The market is coming into the day in a precarious situation with the trade war escalating overnight with China. The 200-day moving average will be violated at the open, and a strong possibility that we see a significant sell-off that could take us, ultimately, back to the February lows to be retested. The double bottom, talked about below, is in jeopardy of being nullified today.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment