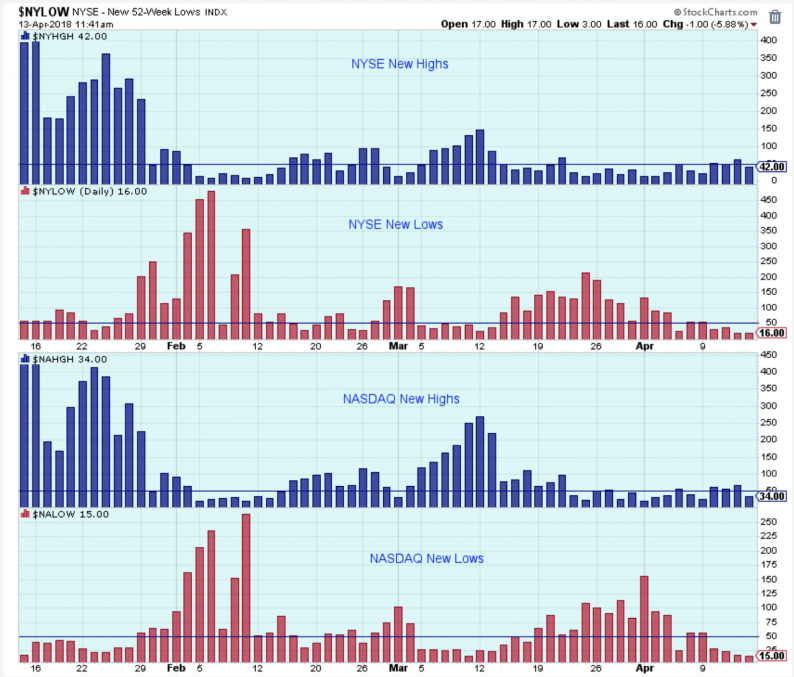

The market wants to rally short-term, but it just can’t find the buyers. An uptrend has to have a number of new 52-week highs, and there are very few at the moment.

Side Notes:

VIX Squared has reported on Twitter that bullish sentiment is now down to a level that favors stock prices from a contrarian point-of-view.

Investors.com pointed readers to a CBO report that estimates the Federal deficit to be at least 2 Trillion dollars by 2028. Insanity!

Outlook Summary:

The mood swing away from stocks was inevitable after such a terrific run higher for stocks starting with the 2016 election.

I don’t think the bull market is over yet, but it is getting old and we have been very fortunate over the last ten years. Time to start appreciating what we have, and protecting it as best we can.

The long-term outlook is increasingly cautious. Reduce overall exposure to stocks on rallies

The medium-term trend is down

The short-term trend is down.

The medium-term trend for bonds is up.

Investors are over-reacting to political headlines, and under-estimating the impact of fiscal stimulus.

The reasons to be optimistic or negative are roughly balanced.

Fundamentals will continue to provide the tailwind need to support prices.

Investing Themes:

Technology

Banks and Brokers

Payment Processors

Military Defense

Emerging Markets

Strategy:

Buy large cap stocks and ETFs on pullbacks of the medium-term trend.

Buy small cap growth stocks on break outs to new highs during short-term up trends.

Stop buying when the short-term trend is at the top of the range.

Take partial profits when the uptrend starts to struggle at the highs.

Never invest based on personal politics.

Leave A Comment