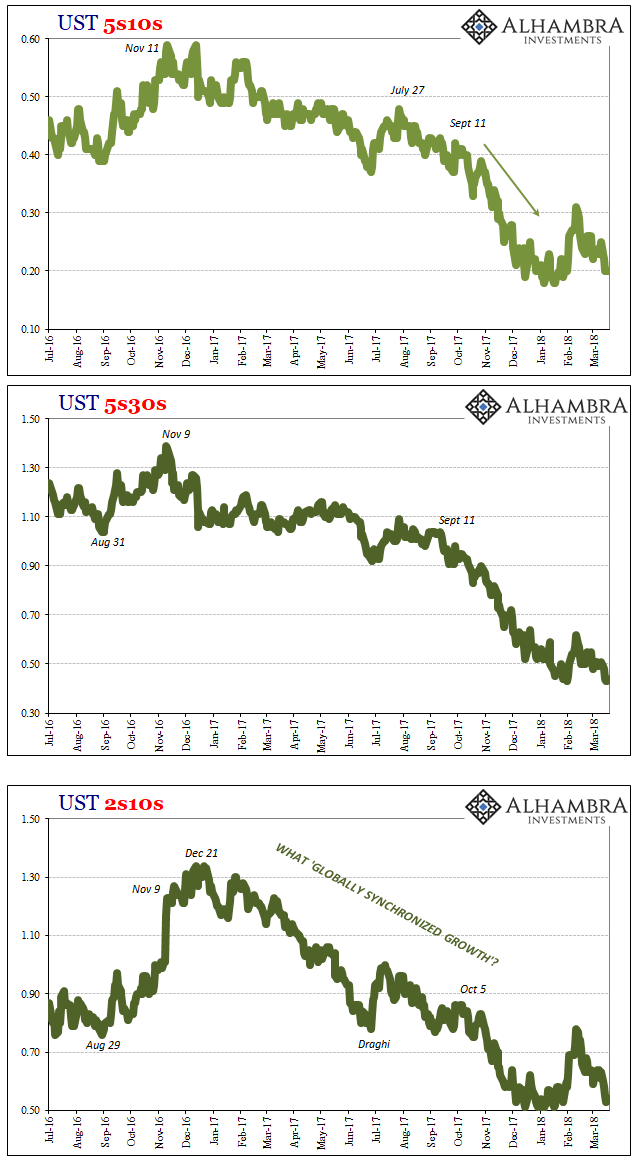

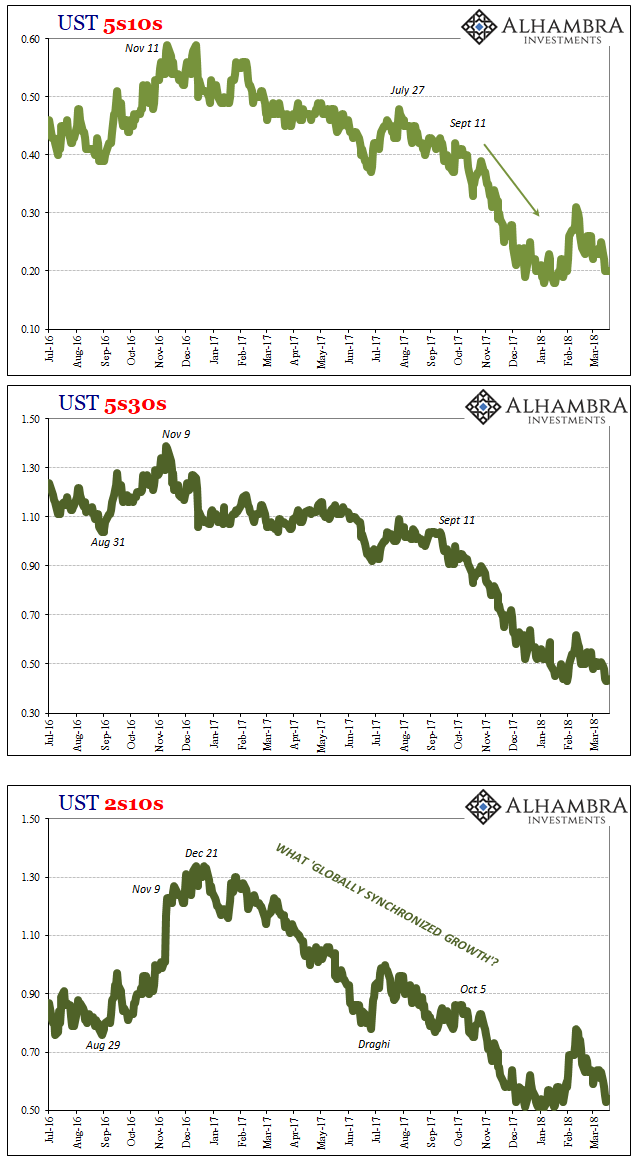

Tomorrow, it is widely expected that the FOMC will vote for another 25 bps “rate hike.” The long end of the UST curve is already just as unenthused as ever, while the short end expects higher yields on money substitutes. The result is the very familiar collapse in the yield curve, one that like both of the prior “rate hike” regimes (1999-00; 2004-06) leads to economic conundrums the monetary policy committee no doubt will continue to debate in total intellectual darkness.

Two decades is, apparently, insufficient to expect progress on the topic.

The funny thing is that it was nearly two decades ago when Paul Krugman of all Economists proposed the very symptoms this and other central banks now face. In 1999, Dr. Krugman was obsessed with the idea of a liquidity trap – a condition whereby no matter how much the money supply may be increased the result in a real economy was “pushing on a string.”

He began his talk with the usual disingenuous compliment:

We live in the Age of the Central Banker – an era in which Greenspan, Duisenberg, and Hayami are household words, in which monetary policy is generally believed to be so effective that it cannot safely be left in the hands of politicians who might use it to their advantage. Through much of the world, quasi-independent central banks are now entrusted with the job of steering economies between the rocks of inflation and the whirlpool of deflation. Their judgement is often questioned, but their power is not.

Krugman then goes on (and on) to question their power. He describes, essentially, the case where they are, surprise, powerless. This liquidity trap situation manifests in several key indications.

If, for whatever reason, the natural real rate of interest is negative, then the economy “wants” inflation. You may well ask why and how it should happen that the natural real rate is negative; but just for the moment suppose that it is. Then the economy will find itself in a liquidity trap as long as the private sector does not expect sufficiently rapid inflation.

No matter what the Fed, BoJ, or any of the others might do in this situation, it won’t provoke the inflationary response. Why? Dr. Krugman proposes the time horizon, or time constraint.

Monetary expansion is irrelevant because the private sector does not expect it to be sustained, because they believe that given a chance the central bank will revert to type and stabilize prices. And in order to make monetary policy effective, at least in a simple model, the central bank must overcome a credibility problem that is the inverse of our usual one. In a liquidity trap monetary policy does not work because the markets expect the bank to revert as soon as possible to the normal practice of stabilizing prices; to make it effective, the central bank must credibly promise to be irresponsible, to maintain its expansion after the recession is past.

Leave A Comment