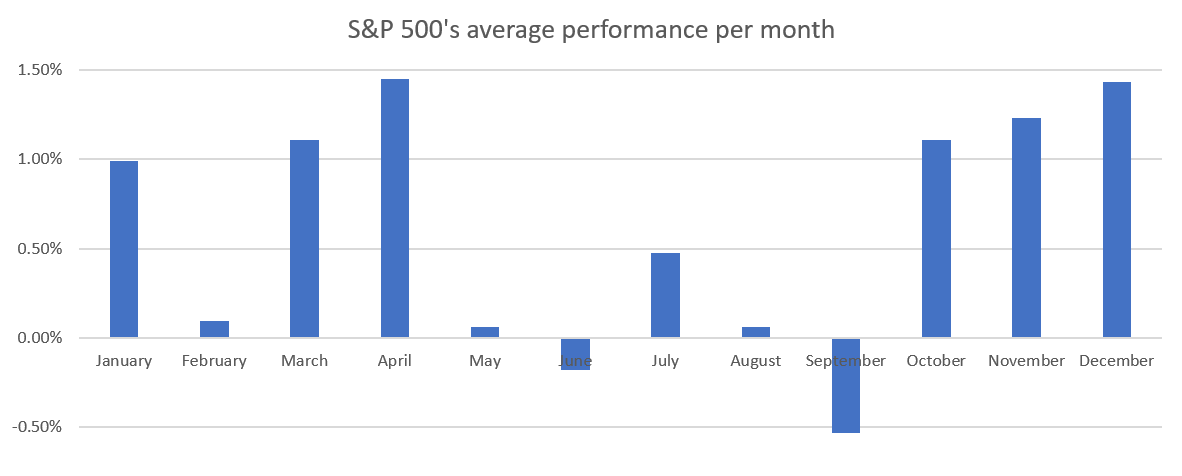

As you probably already know, the stock market’s seasonality is bearish from May – September. That’s where the phrase “Sell in May and go Away” comes from.

The stock market has bucked “Sell in May and go Away” this year. It has gone up every single month in Q2 2018 (April, May, June).

When the stock market bucks bearish seasonality (i.e. the stock market goes up when it “should” go down), the stock market’s future returns are very bullish.

Here’s what happens next to the S&P 500 when it goes up every month in Q2 (April, May, June). We’re using the monthly CLOSE $.

Click here to download the data.

Conclusion

As you can see, the stock market has a VERY STRONG tendency to go up in the next 6-12 months when it goes up every single month in Q2. This means that the S&P 500 will probably be higher at the end of 2018 through to the middle of 2019. The forward returns are also VERY BULLISH. The median return for 6 months forward is 12.9%

When the stock market goes up in April, May, and June, it’s usually in a “big rally” within a bull market. That’s why the stock market’s future returns are so bullish. The stock market usually goes down in April, May, or June during “significant corrections” or bear markets.

This supports the Medium-Long Term Model. Based on the current data, the Medium-Long Term Model suggests that the next “significant correction” or bear market will probably begin in the second half of 2019.

12.9% above the S&P’s current level (2718) is 3068. This suggests that the S&P 500 will probably close somewhere in the vicinity of 3000 at the end of this year.

Leave A Comment