What makes a stock bubble is really two parts. Most people might think those two parts are money and mania, but actually money supply plays no direct role. Perceptions about money do, even if mistaken as to what really takes place monetarily from time to time. In fact, for a bubble that would make sense; people are betting in stocks on one monetary view that isn’t real, and therefore prices don’t match what’s really going on.

These opinions during an asset bubble become rationalizations, which is the first part required for one. The second part is what investors are rationalizing, that the underlying fundamental conditions have nowhere to go but up. It becomes hard coded in trading regimens that whatever it is today can only be an order of magnitude better tomorrow; thus, buy today before you miss the can’t miss.

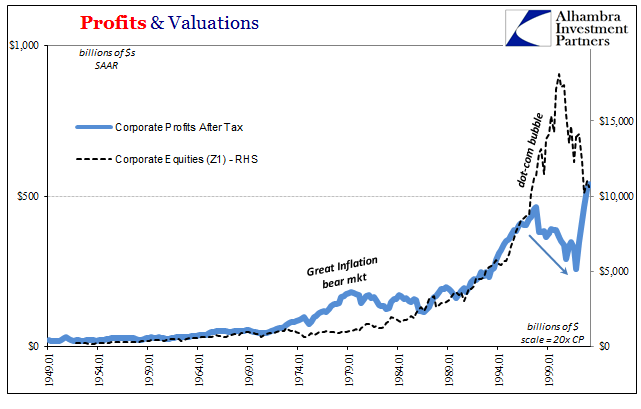

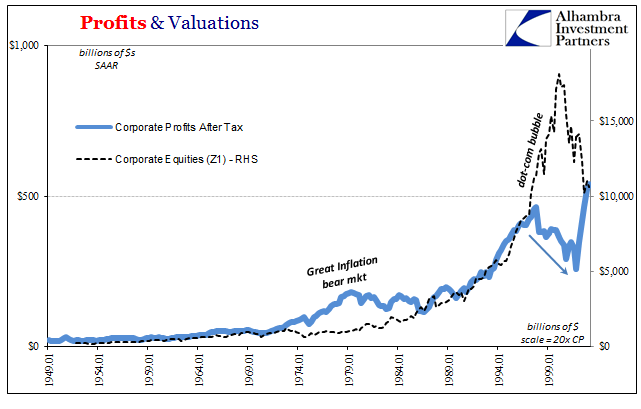

The dot-com bubble was exactly that. According to several measures of profitability, including those provided by the Bureau of Economic Statistics as part of their GDP (really GDI) data set, it was a true bubble in that sense. The BEA estimates the corporate profits hit their maximum in late 1997. Prices rose, often insanely, while underneath there was no confirmation for them.

It didn’t matter at least for a time because the economy is not the market, and the market is not the economy in the short and even intermediate terms. The big, general rationalization of that era was that earnings and profits would have to rise in the economic promise of the “new” internet/telecom economy as it replaced the brick and mortar old one. Whether self-delusion or honest mistake, the attempted “forward earnings” validation failed because earnings, meaning economy, didn’t ever follow the apparent logic.

There was no “new” economy, at least not in the United States (thanks to eurodollar expansion).

In terms of corporate profits, there was something of a recovery in them following the Great “Recession.” There would almost have to have been since the magnitude of layoffs was so immense. That was more a function of liquidity and cash flow than strictly earnings and profits, therefore it was, as in all prior monetary panics, overdone on the economy side (labor as well as capex).

Leave A Comment