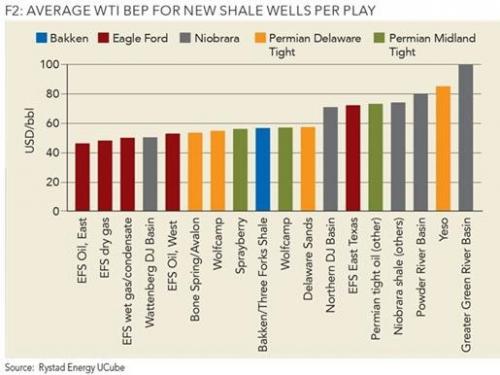

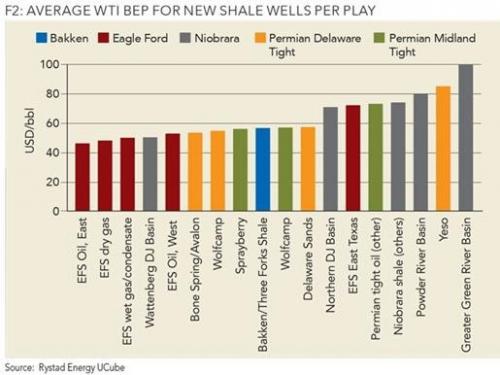

While the media continues to blast the occasional OPEC production-related headline, the reality is that crude supply is increasingly becoming a shale story, as the US, now tens of billions in debt lighter – has rapidly emerged as the low-cost, marginal oil producer. As such absent a sharp rebound in prices in the coming 3 months, OPEC is almost guaranteed to revert to its prior production regime, as Saudi Arabia is already pained by the loss of market share to increasingly lower cost US producers, who as shown in the charts below, have seen their all-in production costs plunge thanks to rapid technological advancement.

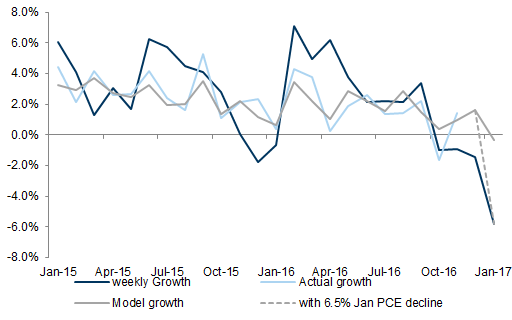

And yet, when trying to forecast the price of oil, it is becoming increasingly clear that the answer is not on the supply side at all but rather on the demand, where as we have been writing for the past month, things are getting quite troubling. While we urge readers to familiarize themselves with our recent coverage of collapsing gasoline demand to a level which according to a perplexed Goldman Sachs suggests the US economy should be in a recession…

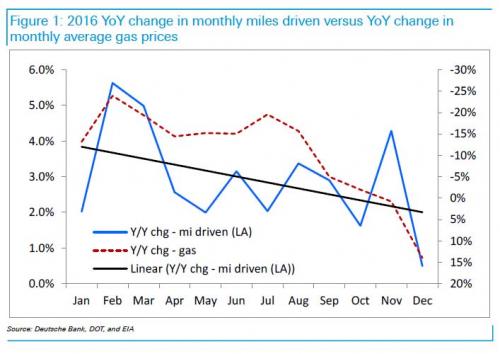

… other troublesome indicators have emerged confirming that not all is well on the demand side. The latest evidence comes from a recent report by Deutsche Bank which shows that the number of miles driven in the US is not only slowing, but in December, it posted the smallest monthly increase since November 2013.

As DB’s Mike Baker writes, “we have hypothesized that the increase in gas prices could pressure miles driven, which as noted below slowed in 2016 versus 2015, and even more so towards the end of the year after the Thanksgiving inflection. The 0.5% increase in miles driven in December 2016 is the smallest monthly increase since November 2014. Gas prices inflected around Thanksgiving 2016 and are up year-on-year on a weekly basis over the last 15 weeks.”

While looking at the above chart of year-on-year change in monthly miles driven in 2016 versus the year-on-year change in average monthly gas prices, Baker notes an approximately (60%) correlation. He then notes that the concern is that gas prices were up only 14% year-on-year in December 2016. The reason why this is troubling is that while there is still no concurrent data, the national average price was approximately $2.23 per gallon as of February 27, 2017 and the price per gallon has increased more than 30% year-on-year over the last three weeks.

Leave A Comment