You know, I saw this yesterday and I wasn’t going to dedicate a separate post to it, but I think I will because if nothing else, it’s absurd and readers seem to like things that are absurd (like “Space Force“, for instance).

Early yesterday morning, I tweeted this:

Lol. Japan 10-Year Govt Bonds Untraded for First Time Since June 2017

— Walter White (@heisenbergrpt) March 13, 2018

So on Tuesday, not a single 10Y JGB traded. That was the first time we’ve seen a completely lifeless session since June 29.

“As the key 10-year bond was not traded, the JGB market was generally thin,” Barclays’ Naoya Oshikubo noted, rather dryly. “It was difficult for markets, including stocks and currencies, to move ahead of the U.S. data”, he added.

Yeah, I mean markets were hesitant ahead of CPI in the U.S., but we all know what’s going on here. Kuroda has cornered the JGB market. He owns something like 40% of it and on some issues, he’s damn near the only game in town.

I don’t want to spend a ton of time on this, but suffice to say it’s not entirely clear how this market is going to respond if he ever pulls out (although full disclosure, I have never spoken to Kuroda about how prone to “pulling out” he is). Recall these charts from BofAML out last summer:

Again, those are dated, but for what it’s worth, here’s the commentary that accompanied them last June:

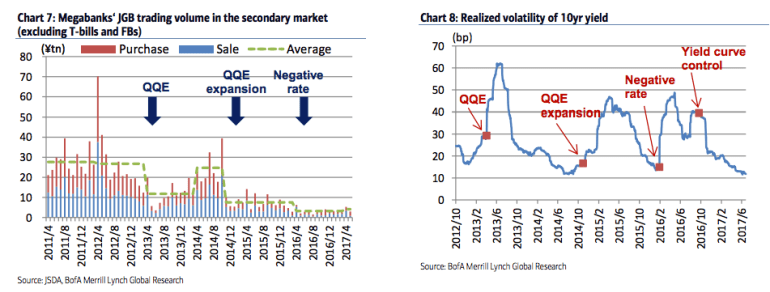

JGB transactions by megabanks in the secondary market have greatly declined since QQE was introduced. Before QQE, these transactions averaged slightly less than ¥30trn per month, but they have sunk by 90% to about ¥3trn recently (Chart 7). The JGB market’s volatility sharply declined after the introduction of YCC, giving the impression that the policy was working effectively.

However, in a market with reduced liquidity and activity, attention should be paid to the risk that a slight movement could send volatility much higher. In the past, BoJ policy changes have been followed by reduced liquidity and higher volatility (Chart 8).

Leave A Comment