My Swing Trading Approach

If the market is interested is reversing the selling of the past two days and rallying, I will be interested in adding 1-2 new positions to the portfolio. Beyond that, I will continue raising my stops on existing positions.

Indicators

Industries to Watch Today

No sector was spared yesterday. Energy is the most damaged and could be experiencing a reversal here, while Consumer Cyclical chart remains the best, and most intact.

My Market Sentiment

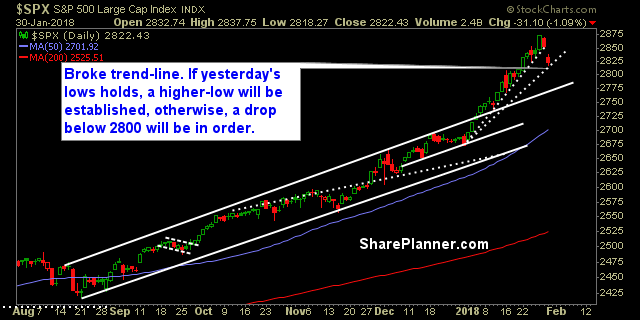

Yesterday’s sell-off, was the worst sell-off seen since May of last year. The rising channel that price was trading in, was broken. Today will be key for the markets as yesterday’s lows will need to hold, otherwise, a retest of intermediate trend-lines will be tested below 2800.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment