Toys R Us just joined the unenviable list of top retail failures of the past decade: Circuit City, Linens-N-Things, A&P (the Great Atlantic & Pacific Tea Company), Sports Authority, and Radio Shack (whose downfall we called in 2016).

While there are many reasons for the loss of these once household names, and Toys R Us is citing massive debt burdens as one element in its undoing, there is a much bigger – and more predictable – underlying factor.

Demographics!

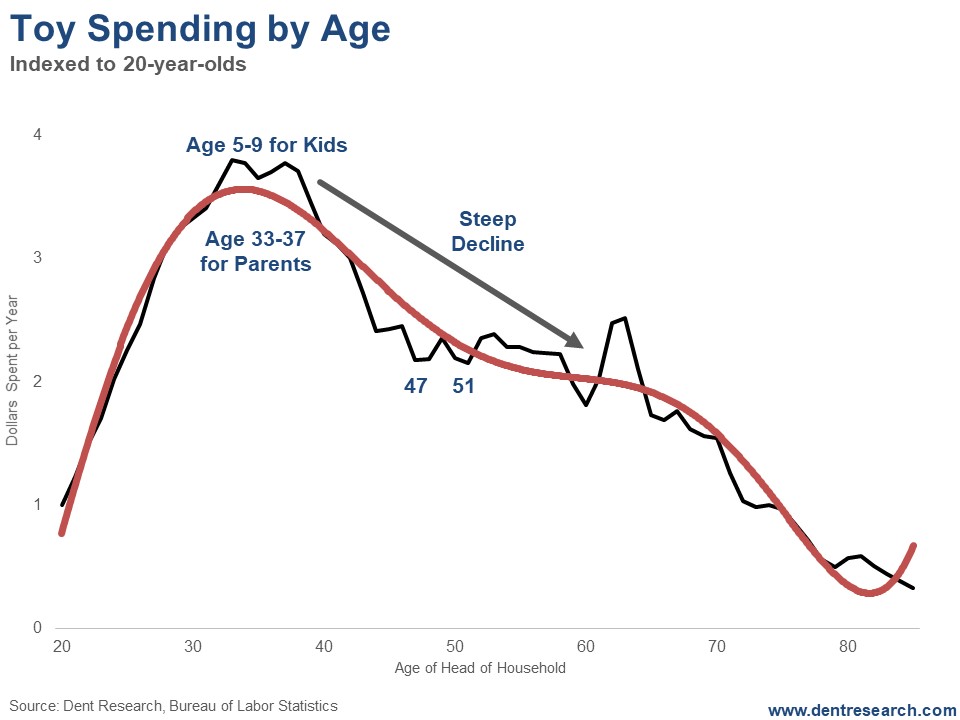

It’s not hard to figure out when toys are most in demand. Age 5 is the peak for kids. There’s a plateau between the ages of 5 and 9. And then a steep drop-off… kids grow up and graduate to alcohol and ecstasy parties instead.

Look at this chart (we have everything from cradle to grave).

And, by the way, for kids, spending on babysitting peaks at the same age as spending on toys: 5 for kids, 33 for their parents.

And calorie intake peaks at age 14 (so spending on potato chips peaks at 42 for parents).

And height peaks at age 19…

And those “minor” bills for college education? They peak when parents are 51 years old on average.

Got any other questions about spending peaks? We’ve got the answers!

But back to toys…

On a 5-year lag, toy spending would have peaked for the Millennial generation in late 2012. With the plateau into age 9, spending would have stayed buoyant into late 2016. After that? Tickets baby!

Toys R Us was a victim of two key trends in our time: debt and demographics.

But probably more important: Toys R Us (and Lego is in trouble as well) is a leading indicator of our entire economy ahead, when endless free money and stimulus hits its nasty hangover.

For Toys R Us, it was a classic leveraged buyout, with $5.3 billion in debt pledged against assets and $7.9 billion in total debt.

Leveraged up to its eyeballs…

And by my old employer, Bain & Company (Bain Capital). If only they’d consulted me before entering a collapsing demographic sector.

Leave A Comment