Headline data for truck shipments show improved growth in November.

Analyst Opinion of Truck Transport

I tend to put heavier weight on the CASS index which showed stronger growth year-over-year. The ATA data showed a similar trend but their overall trend line seems wrong.

It should be pointed out that although the data seems to be improving, it is nothing to write home about when compared to previous years.

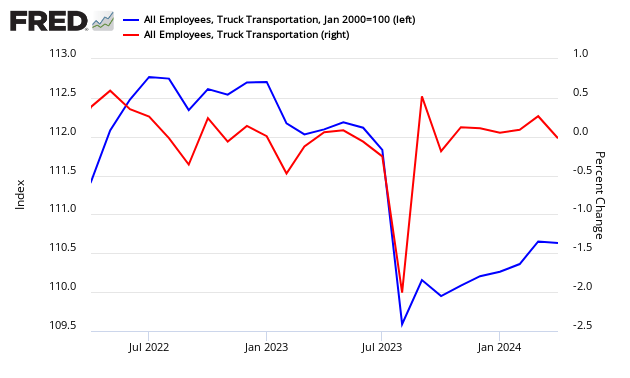

It is also interesting that the current trucking employment pattern shows a declining rate of growth over the last few years.

ATA Trucking

American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index jumped again in November, adding 2.3% in addition to the 3.9% jump during October. In November, the index equaled 151.8 (2000=100), up from 148.4 in October. Said ATA Chief Economist Bob Costello:

The freight market is really strong. The solid truck tonnage figures over the last four months suggest to me that this holiday spending season might be better than many expected, and the best in several years. The strength in tonnage also shows that other parts of the economy are doing well, too, including business investment, factory output, and even construction.

ATA Truck tonnage this month

z truck.jpg

Compared with November 2016, the SA index surged 7.6%, which was down from October’s 10.5% year-over-year gain, but still very strong. In September, the index increased 6.3% on a year-over-year basis. Year-to-date, compared with the same eleven months in 2016, the index is up 3.5%.

Econintersect tries to validate ATA truck data across data sources. It appears this month that jobs growth says the trucking industry employment levels were little-changed month-over-month. Please note using BLS employment data in real time is risky, as their data is normally backward adjusted (sometimes significantly).

This data series is not transparent and therefore cannot be relied on. Please note that the ATA does not release an unadjusted data series (although they report the unadjusted value each month – but do not report revisions to this data) where Econintersect can make an independent evaluation. The data is apparently subject to significant backward revision. Not all trucking companies are members of the ATA, and therefore it is unknown if this data is a representative sampling of the trucking industry.

Leave A Comment