Headline data for truck shipments showed very different trends and growth rates – depending on the source of the data.

Analyst Opinion of Truck Transport

I tend to put heavier weight on the CASS index which continues to show a strong and upwardly trending rate of growth improvement year-over-year. CASS rate of improvement is 8.2 % YoY whilst the ATA is 2.9 % YoY.

It should be pointed out that the trucking movements are improving YoY – and the likely reason is the shift from box stores to eRetailers.

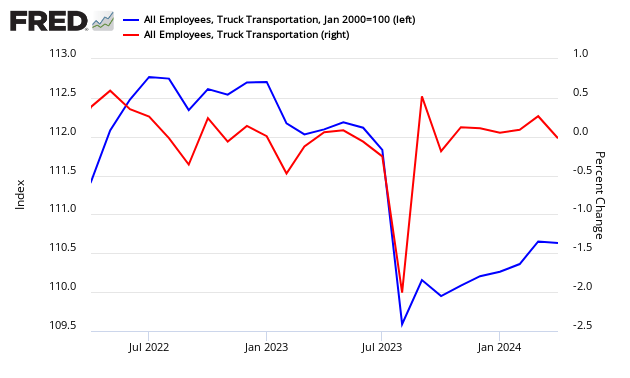

Econintersect tries to validate truck data across data sources. It appears this month that jobs growth says the trucking industry employment levels rate of growth improved in September – which is consistent with Cass. Please note using BLS employment data in real time is risky, as their data is normally backward adjusted (sometimes significantly).

ATA Trucking

American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.8% in September after decreasing a revised 2.0 % in August.

Said ATA Chief Economist Bob Costello:

Truck freight slowed at the end of the third quarter. As anticipated, the year-over-year gains have slowed on strength a year earlier, but there is no doubt that freight softened in August and September. Despite the decreases late in the quarter, based on July’s strength, third quarter tonnage rose 0.1% from the second quarter and 5.2% from the same period in 2017.

ATA Truck tonnage this month

Compared with September 2017, the SA index rose 2.9%, down from August’s 4.2% year-over-year increase. Year-to-date, compared with the same period last year, tonnage increased 7.0%.

source: ATA

CASS FREIGHT INDEX REPORT

Leave A Comment