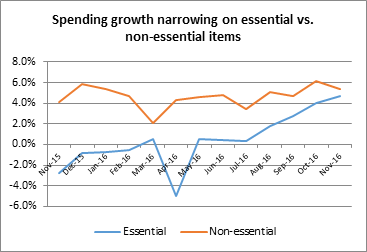

We did get some awesome Consumer Spending numbers yesterday but, as you can see from the chart, it’s more of a reflection of inflation than of a confident consumer that’s out shopping. The cost of “essentials” has risen sharply since May, up 8% while discretionary spending has remained flat. I imagine when the credit card data comes out – we’ll see that a lot of this spending has been debt-financed – not the best kind of spending…

Still, the market hates nuance so YAY!!! Speaking of nuances, did you know that Fitch, Moody’s and the S&P have taken a record 1,971 negative ratings actions on emerging-market sovereign and government-related entities in 2016 – and the year isn’t even over yet! Isn’t that awesome??? Not since 2007-2008 have we had this kind of uptick in negative ratings and back then the record was only 1,400 – we shattered that in September!

Now I’m not going to say this is a bad thing because NOTHING is a bad thing as far as this market is concerned but, it’s kind of a bad thing. 26% of the 134 Sovereigns rated by Moody’s still have a negative outlook – so things can get even worse. When a sovereign defaults, there’s a domino effect of companies, private and state-owned, that follow. For once, S&P, Moody’s and Fitch may be giving investors early indications of what to expect. The message for now is clear: Developing nations are no longer doing that well.

I’m not going to dwell on the negative, not when Bloomberg did such a good job of it in their “Pessimist’s Guide to 2017”.

We tried shorting yesterday and that failed, with our stops quickly broken to the upside but we’re at is again today. In yesterday’s post, I said the Nikkei(/NKD) was my favorite short at 18,500 and we made a +$500 move down to 18,400 (now back to 18,450) but that was disappointing given the Dollars sharp fall back to 100 so today we’re not into them but we do have 19,225 on the Dow Futures (/YM) and those components are very stretched and oil is coming down, which is bad for Dow heavyweights Exxon (XOM) and Chevron (CVX), so that one is today’s favorite short.

Leave A Comment