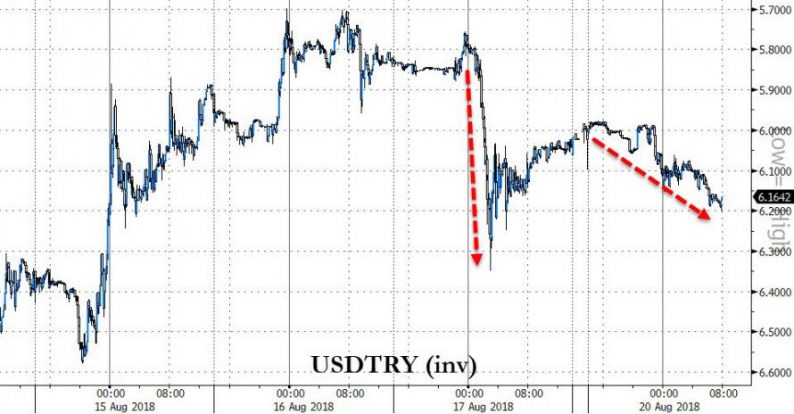

With Turkish capital markets closed for a week-long holiday, traders expected last week’s Turkish Lira fireworks to remain subdued. And yet, after closing for trading at around 6.00 last Friday, the Lira has resumed its drop, and was trading as low as 6.20 against the dollar after an unknown driver fired shots at the US embassy in Ankara (nobody was hurt), and a report from the WSJ that the US has rebuffed all possibility of negotiations over the release of pastor Brunson.

And according to a new report from SocGen analyst Phoenix Kalen, today’s drop may be just the start of the latest sharp slide in the Turkish currency, one which will eventually see the lira drop to 7.0 by the end of the third quarter, then tumbled as low as 8 by the end of the year, before regaining some ground back to 7.0 by the end of the first half of 2019.

Kalen first lays the underlying drivers for Turkish asset deterioration as follows: overly-loose monetary policy, market participants perceiving a lack of central banking independence/credibility, a deteriorating fiscal stance, a large current account deficit that is financed by short-term flows, and an ongoing eastward political shift.

Seeing little hope that any of these adverse catalysts will change in the near future, SocGen sees Turkey engaged in a protracted trudge “toward the brink of a financial crisis“. Furthermore, the French bank no longer expects an imminent substantial interest rate hike by the CBRT before its 13 September MPC meeting. Meanwhile, as Turkey-US diplomatic relations have deteriorated, focusing the public’s attention on Erdogan’s nationalistic agenda, Turkish policymakers are taking short-term measures to address financial stability by attacking short sellers and market liquidity without tackling macroeconomic and monetary policy imbalances.

The punchline: SocGen sees USDTRY trading up to 8.0 before reaching the “pain threshold that compels Turkey to compromise on some of its strategic objectives.” In other words for Erdogan to fold in the diplomatic war with trump, the lira will have to plunge to a new record low.

Digging into the report, in its assessment of the likely scenarios for how Turkish authorities will respond to the country’s challenges in the coming months, Kalen lays out three possible scenarios, of which the most likely one (55%) is that the nation continues on its protracted trudge toward a financial crisis, with the resulting financial stress eventually prompting capitulation. And while there is a modest probability for the worst-case scenario, SocGen also sees an outcome in which Turkey “descends into economic and financial crisis” with the USDTRY climbing to 9.0.

Here are the details via SocGen:

55% probability (base case): Protracted trudge toward the brink of financial crisis.

Leave A Comment