October continues to utterly stink for me because of the one-two punch of (a) strong equities and (b) strong commodities. I’m far from giving up hope, however, because the individual equity charts look as good as they ever did, and as prices have ascended, the quantity of sensible opportunities has expanded, since the risk/reward ratio is becoming more appealing across the board.

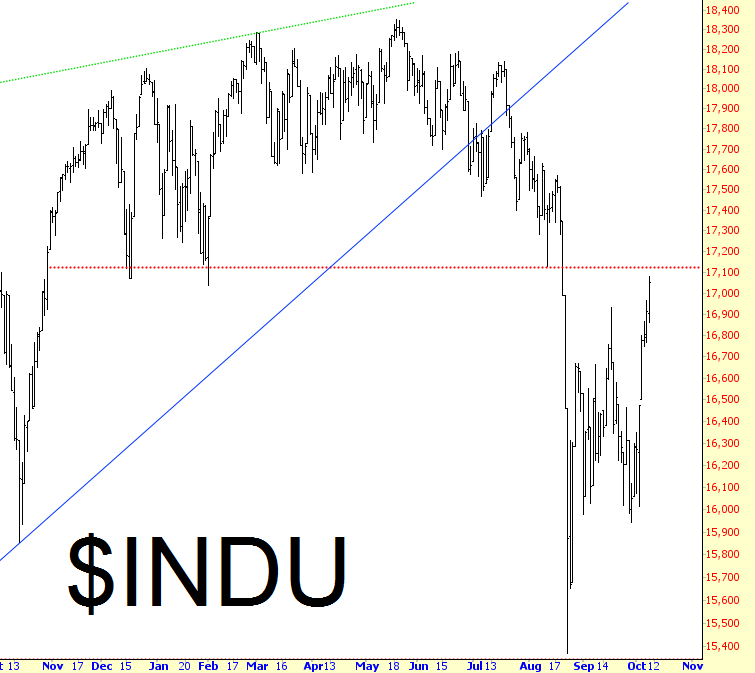

The “easy” part of the bull run is just about done, I think, as most indexes approach the huge overhang of supply. A couple of weeks ago, stocks were so battered that adding to shorts didn’t make sense. At present price levels, I think we’re getting a second bite at the apple. The Dow Industrials has a huge top between 17,100 and 18,400, and the 1700 point rise in the Dow (!!!) since the August crash puts us just beneath that big top.

The S&P tells a similar story, but as with most indexes, there may still be a little room left to go higher before things really truly worrisome for the bears. 2020 (hence the post’s title) is an important level of resistance. If that is crossed, I’d say that approximately 2045 becomes key.

Volatility has gotten absolutely clobbered. It’s hard to believe that only weeks ago we were in the 50s on the VIX, and now we’re back into the same level as before any of this stuff starting happening, well into the mid-teens. About 70% of the volatility from the mini-crash is gone.

The Major Market Index is also at a point where the ascent should really start slowing down. Take note of how much more activity there is between present price levels and the record highs versus the “hot knife through butter” price action beneath 1760.

So, again, the easy-to-remember number 2020 is important. If we cross it with gusto, the charts are really going to lose their clarity. Remember, Monday is Columbus Day, a bank holiday, although equity markets will remain open. See you on Friday morning!

Leave A Comment