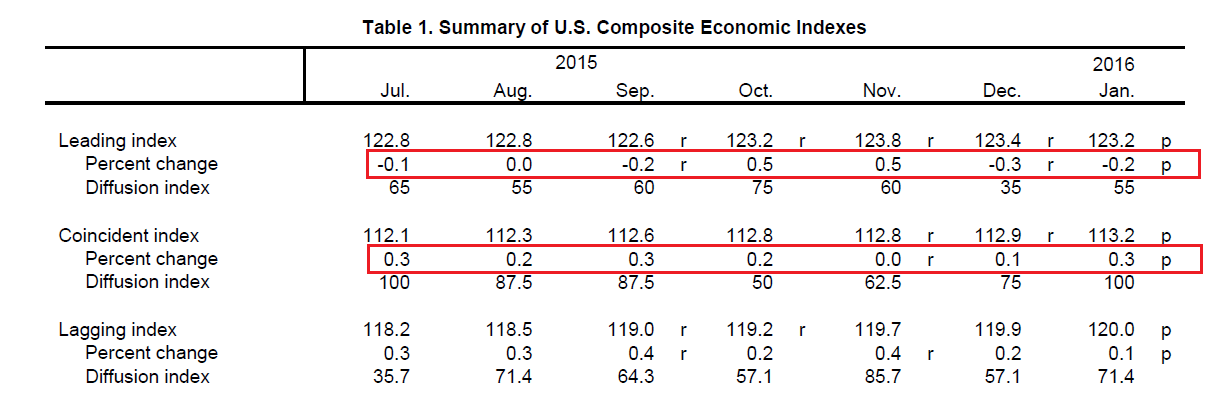

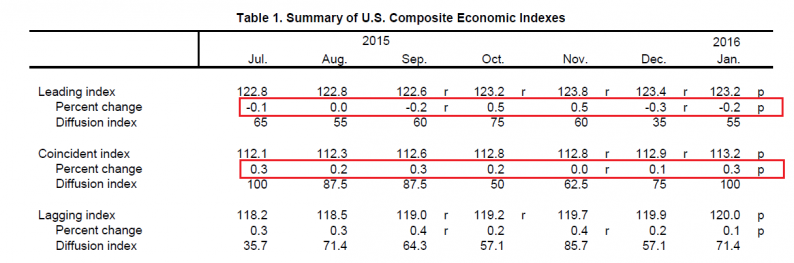

Once again, the LEIs and CEIs are split; the LEIs decreased .2% while the CEIs increased .3%:

4/10 LEIs decreased while one was unchanged.In contrast, all the CEIs increased – even industrial production, which, for the last five months, subtracted from growth.This combination of weaker LEIs but slightly stronger CEIs leads to the following conclusion:

The Conference Board LEI for the U.S. declined for the second month. As a result its six-month growth rate has moderated further and is considerably slower compared to six months ago. Meanwhile, The Conference Board CEI for the U.S. has been rising through January, and its six-month growth rate has been relatively steady. Taken together, the current behavior of the composite indexes and their components suggest that the expansion in economic activity should continue in the near term, but the pace of growth will remain modest.

The Fed released their latest Meeting Minutes which contained the following observations of various GDP components:

- Income was increasing, and

- Sentiment was positive

Most important were the several paragraphs the Fed spent on financial market turbulence:

Domestic financial conditions tightened over the inter-meeting period, as turmoil in Chinese financial markets and lower oil prices contributed to concerns about prospects for global economic growth and a pullback from risky assets. The increased reluctance to hold risky assets was associated with a sharp decline in equity prices and a notable widening in risk spreads on corporate bonds. Treasury yields declined across maturities, reflecting a downward revision in the expected path of the federal funds rate and likely some increase in safe-haven demands amid the market turbulence. The dollar appreciated against most foreign currencies.

Leave A Comment