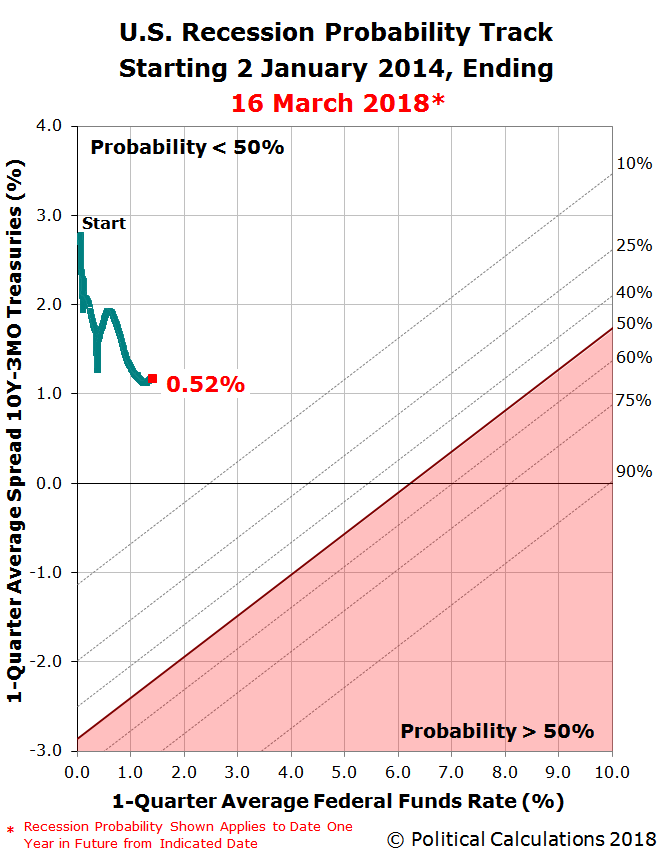

The risk of a national recession beginning in the United States anytime in the next year, or specifically between 16 March 2018 and 16 March 2019, is slightly over 0.5%. If that sounds very familiar, that is because we wrote an almost identical lead sentence nearly six weeks ago!

Then, as now, the occasion for our using that introductory sentence once again is the eve of a two-day meeting for the Federal Reserve’s Open Market Committee (FOMC), which is expected to announce that it will boost its target range for short term interest rates in the U.S. by a quarter percent, increasing to be between 1.50% and 1.75%.

But it hasn’t yet, so the probability of a national recession starting sometime in the next 12 months has remained about the same, as confirmed by the latest update to our recession probability track.

This update confirms a prediction that we almost identical lead sentence, where we made the following observation after finding something worth noting about the direction of U.S. Treasury yields:

The interesting thing about what’s happening in the bond market is that long-term yields are increasing faster than short term yields, where the spread between the 10-Year and 3-Month constant maturity Treasury yields bottomed at 0.98% on 27 December 2017. Since then, the spread between the two Treasuries has opened up to 1.29%.

For our recession probability track, that means momentum has been building for a potential reversal in the downward component of its trajectory toward increased odds of recession.

Sure enough, that’s exactly what happened over the last six weeks! Unfortunately, we do not expect that positive trend to continue.

Going into the FOMC’s March 2018 meeting, we find that the trend for the 3-Month Constant Maturity U.S. Treasury since January 2018 is slowly rising yields. Meanwhile, the trend in the yield for the 10-Month Constant Maturity U.S. Treasury has reversed from growing to falling in recent weeks. The two trends together mean that the spread in the U.S. Treasury yield curve, the difference between the 10-Year and 3-Month Treasuries, has begun to shrink once more.

Leave A Comment