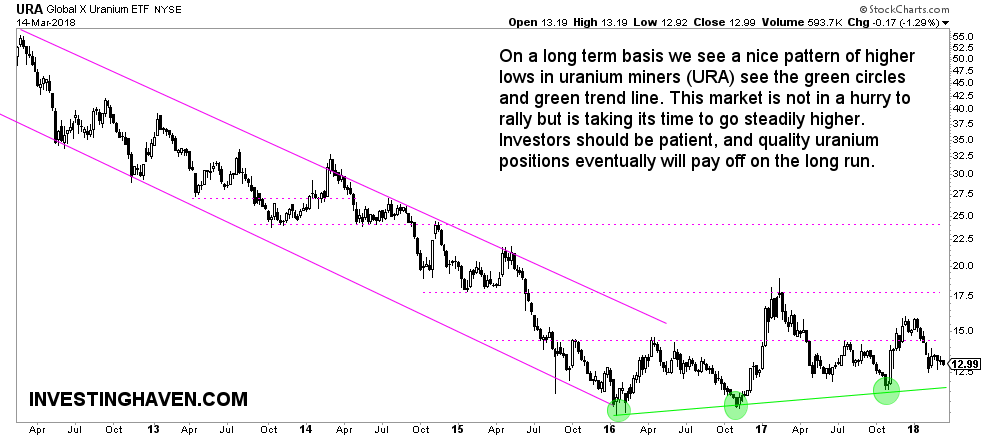

The uranium market is one of our favorite markets since October 2016 when uranium markets set a higher low on its secular chart (middle green circle annotated on below chart). That was a first sign of a major trend change, way before the breakout of 2017 took place.

Early last year there was this mega breakout on the chart, specifically the uranium miners representedy by URA ETF.

At the end of last year we observed the following 3 things:

We thought a strong bull market would start but, as it looks now, it is more of a mildly bullish trend that is ongoing in the uranium market. That is likely setting the stage for a strong bull market later down the road. The trillion dollar question, of course, is when exactly will the bull market accelerate.

Here, of course, it becomes interesting, because we recognize a typical pattern which we see over and over again. A mildly bullish period comes also with selloffs. It may take time until an acceleration takes place which leads many investors to get discouraged. This is how one can distinguish ‘strong hands’ from ‘weak hands’. The strong hands, also known as smart investors, have patience. They know that the biggest profits are made by waiting; that’s how they catch the strong uptrends.

Based on the pattern outlined below we believe the acceleration in the uranium market is not far away. It may take another year, but who cares? What matters is to accumulate quality names like UEC or Fission Uranium on weakness, and be patient.

Leave A Comment