The US Dollar advanced against its G10 counterparts as Asian markets took their turn to price in the Fed policy outlook implications of last week’s jobs data. The Japanese Yen corrected broadly lower having outperformed against the majors last week.

A quiet economic data docket in European trading hours will put the spotlight on a meeting of G7 foreign ministers. The conflict in Syria is likely to take center stage as US Secretary of State Rex Tillerson briefs his allies after last week’s surprise US airstrike against the regime of Bashar al-Assad.

Rhetoric suggesting that the US administration is now prepared to join regime change efforts may stoke worries about a broadening conflict and weigh against market-wide sentiment. That may offer a lifeline to the Yen amid renewed demand for anti-risk assets.

Later in the day, the spotlight will turn to a speech from Fed Chair Janet Yellen. Comments reiterating the central bank’s intent to continue raising rates and perhaps even hinting that balance sheet reduction may begin before year-end may encourage the greenback to extend gains (Fed policy outlook implications of last week’s jobs data, of course).

Asia Session

European Session

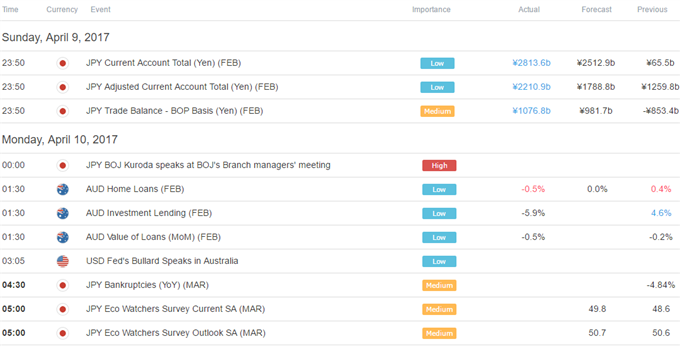

** All times listed in GMT. See the full DailyFX economic calendar here.

Leave A Comment