After initially tumbling in the aftermath of the U.S. missile attack on Syria which jolted financial markets, boosting haven assets and temporarily shifting investor focus from today’s jobs data, S&P futures have managed to recoup all losses (the Nikkei closed up 0.4% after sliding earlier in the session), with Europe also just fractionally lower and climbing fast.

A U.S. defense official told Reuters the missile strike was a “one-off”, helping to calm market nerves. “The U.S. missile strike on a Syrian air base overnight caused a knee-jerk shift into safe havens, although the impact was moderate as it is being interpreted as a one-off proportionate response,” said Ian Williams, a strategist at Peel Hunt in London.

Gold, crude and government bonds were among the biggest winners following the first military strike undertaken by Trump’s administration, as some traders sought safety and others judged increasing tension in the Middle East would spur crude. Russia’s ruble dropped the most in almost a month and its bonds fell as optimism over a detente with the U.S. evaporated. The lira and stocks retreated in Turkey, which shares a border with Syria.

The U.S. dollar recouped all of its losses against a basket of major currencies and was last trading little changed. S&P 500 futures were down 0.1%. European stocks fell 0.3% weighed down by weakness in mining stocks as investors locked in some profits following the sector’s stellar run this year.

While volatility also spiked across global stock markets in the wake of the attacks, the initial impact began to fade for some assets as investors resume digesting a week of developments, from a meeting between Trump and President Xi of China, to Fed signals it may reduce its balance sheet this year and the ECB underscoring its dovishness as Bloomberg notes. Attention now turns to payroll data, after a strong private reading and weak automaker sales gave conflicting signals on the U.S. economy.

As of 6:40am ET, S&P 500 futures slipped less than 0.1% percent, while the Stoxx Europe 600 Index dropped 0.3 percent. Volatility measures from Hong Kong to Europe increased. Asian stocks shook off declines to follow Japanese equities higher, with yen rallying along with Treasuries after Syria strikes. Gilt futures gained after soft U.K. manufacturing data, some buying from domestic accounts being seen, with Russia’s ruble falling most among major global currencies and the nation’s borrowing costs surging as U.S. airstrikes dash hopes for an improvement in ties under Donald Trump.

Spot gold was up a percent while high-rated euro zone government bonds edged lower. The yield on Germany’s 10-year government bonds fell to a one-month low. Overnight, U.S. Treasury yields dropped to their lowest level in over four months at 2.29 percent

“Safe-haven flows are always affected by political events, and when it affects countries where the U.S. and Russia are interested, then investors become even more nervous because of relations (between those two),” said DZ Bank strategist Daniel Lenz.

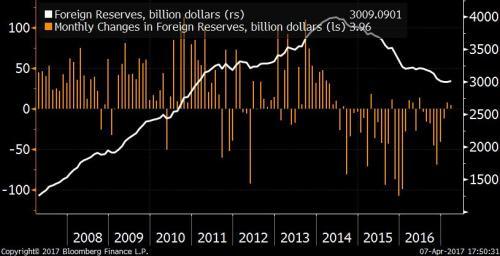

While it will be of secondary importance today, overnight China reported that its FX reserves rose fractionally for a second consecutive month.

Looking at the day ahead, non-farm payrolls may rise by 180k, according to economists (a full preview can be found here) slightly less than the six-month and 12-month averages. Fed’s Dudley speaks on financial regulation. Elsewhere, euro zone finance ministers are due to meet with a discussion on Greece’s progress in implementing reforms needed to unlock aid part of the agenda.

Bulletin Headline Summary from RanSquawk

Market Wrap

Top Overnight News

Leave A Comment