After falling for the first time this year last week, Baker Hughes reports the US oil rig count rose once again (as perhaps Cindy impacted drilling last week) for the 23rd week in the last 24.

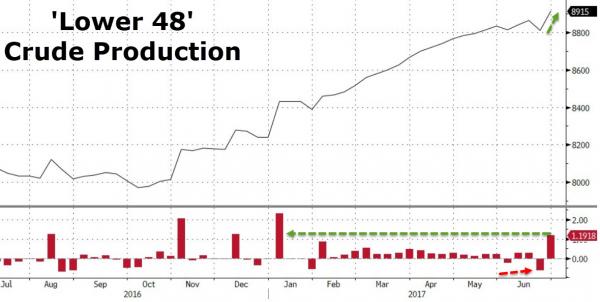

This week saw a resurgence in US crude production (as Cindy’s effects wear off)…This is the highest Lower 48 production since Aug 2015.

And it is that production spike that poured coled water on the short-lived rally after DOE showed inventories dropping. However, as OilPrice.com’s Tsvetana Paraskova notes, the rig count needs to drop drastically further if any equilibrium in the global oil market is possible…

Analysts and investors have been growing increasingly concerned that the OPEC-led production cuts would not be enough to bring the oil market back to balance, and now one investment bank, Morgan Stanley, is saying that if the market stands any chance of rebalancing next year, U.S. shale possibly needs to drop around 150 rigs.

“If OPEC doesn’t balance the market, the oil price will have to force it somewhere else, most likely in U.S. shale. For a chance of a balanced market in 2018, the U.S. rig count can no longer grow and possibly needs to contract ~150 rigs. Given current break-evens, this requires WTI between $46-50,” Morgan Stanley analysts said in a research report on Thursday, as quoted by MarketWatch.

According to Morgan Stanley, despite OPEC’s cuts, global inventory levels are currently around the same high as they were last year.

“To support prices in the mid-$50s, OPEC-12 would probably need to lower production by another 200,000-300,000 barrels a day and extend the output agreement to end-2018. We find this unlikely,” the bank’s analysts said.

“The combination of little impact on physical balances, but a strong signal to invest has meant that the OPEC cuts have had a perverse effect: on current trends, the oil market would be oversupplied again in 2018,” Morgan Stanley warned. And they see U.S. rig count in need of dropping between 120 and 180 rigs to keep oil output from flooding the market.

Leave A Comment