US Session Bullet Report

The ECB press conference currently going on now has sent the EURO into a tailspin as President Mario Draghi announced that forecasts for inflation and GDP have been revised down for the Eurozone.

GDP growth forecasts for 2015 were revised to 1.4% versus 1.5% previously. The dissapointing announcement has added to recent woes over the global slowdown. As a result the EUR was immediately sold off plunging more than 100 points against the USD and JPY and continues to fall at time of writing.

President Draghi also cited the drop in Oil price as a means to support incomes and corporate profits.

Earlier, the ECB kept its base rate unchanged at 0.05% although Draghi indicated the ECB is prepared to use all instruments available if needed, perhaps paving the way for a further rate cut or an increase in its bond purchasing program.

Slightly earlier we had higher than expected jobless claims from US so all is not as rosy as once seemed and tomorrows NFP will most definately set the direction for next week.

Trading Quote of the Day:

Your ability to stick to the strategy is more important than the strategy itself

EURUSD

Pivot: 1.126

Likely scenario: Short positions below 1.126 with targets @ 1.12 & 1.1155 in extension.

Alternative scenario: Above 1.126 look for further upside with 1.129 & 1.132 as targets.

Comment: The pair has broken below a rising trend line and remains on the downside.

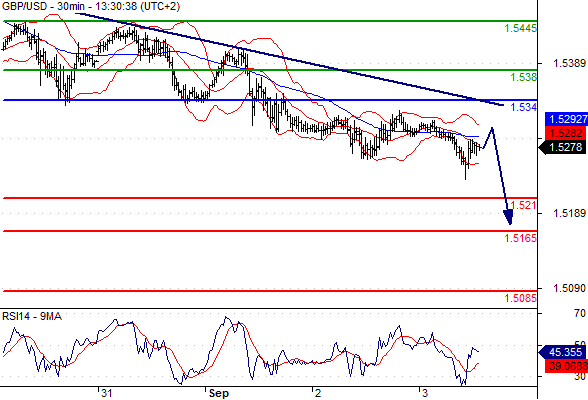

GBPUSD

Pivot: 1.534

Likely scenario: Short positions below 1.534 with targets @ 1.521 & 1.5165 in extension.

Alternative scenario: Above 1.534 look for further upside with 1.538 & 1.5445 as targets.

Comment: The RSI is mixed to bearish.

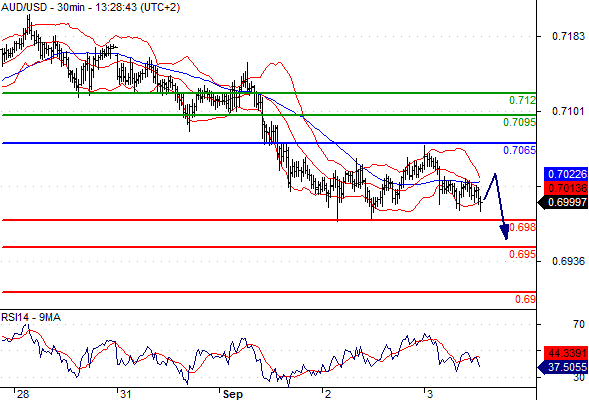

AUDUSD

Pivot: 0.7065

Likely scenario: Short positions below 0.7065 with targets @ 0.698 & 0.695 in extension.

Alternative scenario: Above 0.7065 look for further upside with 0.7095 & 0.712 as targets.

Comment: The RSI is badly directed.

USDJPY

Leave A Comment