The Australian dollar has struggled during the week after initially trying to rally. At this point, it looks like the market is trying to find some type of support, but I think we continue to be range bound between the 0.7350 level above, and the 0.7150 level below. Certainly, being in a downtrend makes selling the rallies a bit easier to stomach, but overall I think that we continue to see a lot of choppiness more than anything else.

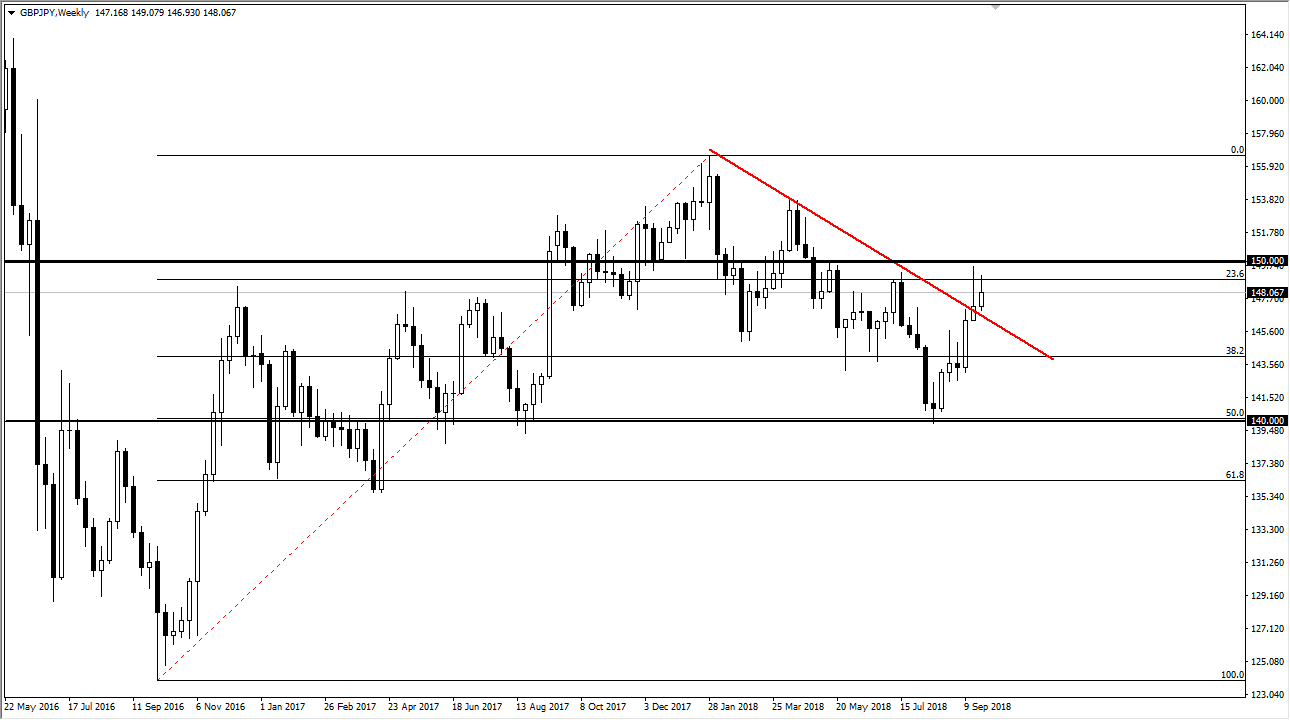

GBP/JPY

The British pound tried to rally against the Japanese yen during the week but pulled back a little bit from just below the ¥150 level. That’s not a huge surprise, considering that the markets have seen a lot of noise in that area and of course it is a large, psychologically significant figure. If we can break above the ¥150 level, this market should take off. Otherwise, I anticipate a lot of range bound trading ahead for the next week, with the ¥147.50 level being rather supportive. A breakdown below that level would be very negative indeed.

USD/CAD

The US dollar initially tried to rally this week but got beat back rather hard as oil markets broke out on Friday. Because of this, we are finishing the week just above the 1.29 level, and more importantly a major support and resistance level. I think that if we break down in close below the 1.29 level on a daily close, we may see a bit of a break down. Otherwise, if we rally from here I think there will be plenty of resistance at about 1.3050. Pay attention to oil, as it rises, that will put downward pressure on this pair.

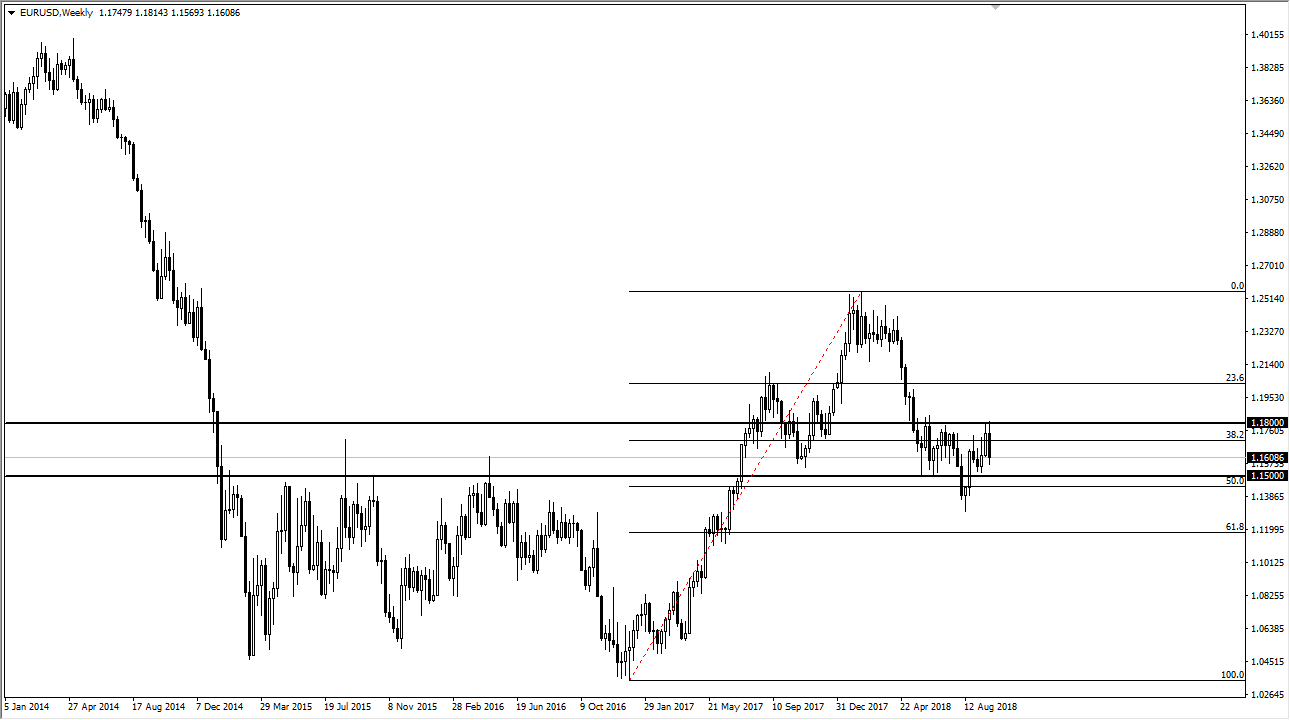

EUR/USD

The Euro initially tried to rally during the week but pulled back from the vital 1.18 level, an area that has been resistance several times. However, by the time Friday ended we get a little bit of a hammer for the day, and this suggests that the 1.15 level will continue to be supportive. In other words, we are stuck in this range and I don’t think that’s changing this week.

Leave A Comment