Welcome back from the long weekend!

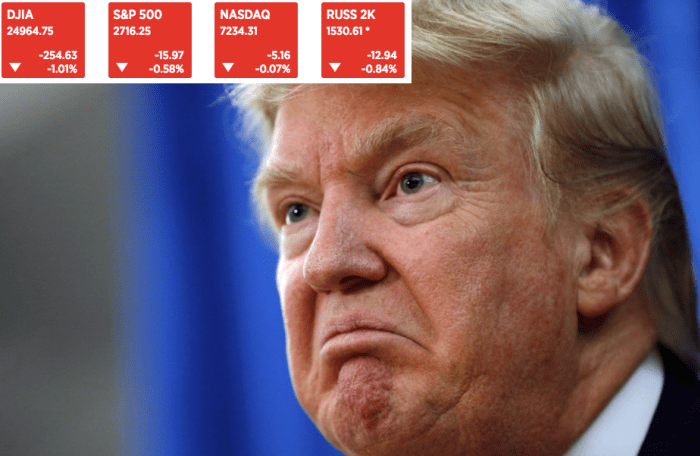

It fell apart for stocks in the last hour of trading on Tuesday as jitters about rising yields and ongoing worries about the fiscal situation and Robert Mueller and [fill in the blank] seemed to overwhelm everyone on the first day back after the long weekend. Walmart didn’t help.

The six-day win streak is over:

The supply deluge from Treasury came and went and although I’m not sure “without a hitch” is the best way to describe it, it was digested relatively well all things considered (and by “all things considered” I mean “considering” the lunatic fiscal path the administration has set America down). The three- and six-month sales were fine, but of course, auction yields were the highest since 2008. The four-week sale saw the lowest bid-to-cover since 2008 and the bid-to-cover on the two-year sale was 2.72 versus 3.22 at the previous auction. Also, note (get it?) the yield on the 2-year sale: 2.255%. I mean, just think about that for a minute. “Way” back on Irma Friday (i.e. just before everyone thought Miami might become Atlantis within 48 hours) 10Y yields looked like they might fall below 2%.

So there was that and then there were more Mueller headlines, a continuation of what we got on Friday and also throughout the long weekend. Long story short, the special counsel probe is nowhere near done and if anything, it looks like the scope is actually expanding.

This was the worst day for Walmart in two years as investors focused on lackluster e-commerce sales and margin pressure in Q4 results:

The dollar was up and is now sitting near a one-week high. Your guess is as good as anyone’s what comes next for the greenback (more here).

Keep an eye on USDJPY – obviously, this has been the story in FX land this month and it’s now up pretty handily from the February 16 lows:

“USD/JPY 105.50 may be a sensitive level for MOF officials,” one London-based trader told Bloomberg, referencing last week’s banter from Asakawa and Aso.

Leave A Comment