Since LIBOR is a hot topic again, though no 2a7 in sight, I thought I’d add one additional perspective that isn’t found in any other analysis. LIBOR is, of course, a money rate applied not to domestic funding but eurodollars on offer in London. The current criticism of the rate stems from the fact that there isn’t volume in unsecured interbank lending these days, meaning that for a lot of LIBOR fixes they relate to what would be offered instead of what actually was.

There is quite a lot of volume, however, in other markets related to LIBOR and interbank rates. Other derivatives markets have developed over time to trade on monetary expectations for various reasons. To do so requires some degree of sophistication, knowledge of the inner workings of global eurodollar banking. You have to take into account more than just what the Federal Reserve might do, largely because it has the ability to change the reference of federal funds (in days past) and now its other corridor-type tools (RRP and IOER).

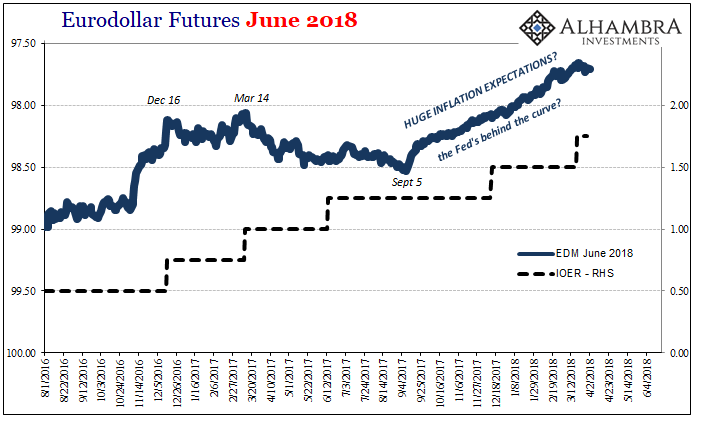

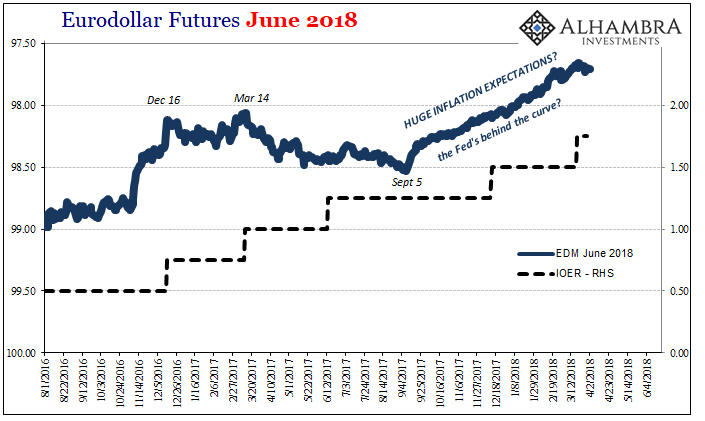

Going on that basis alone, we might observe other market indications of money expectations and conclude that since last year things like eurodollar futures are anticipating a more aggressive FOMC stance. Eurodollar futures, one of the deepest in the world, are settled in 3-month LIBOR and are therefore the best indication of what’s going on in terms of a probability spectrum.

The June 2018 contract will go off the board in a little over two months’ time. As it stands right now, the indicated price is substantially more than where IOER, the upper “floor” for FOMC policy, currently is or where it might be by the third Wednesday this June (assuming another “rate hike” occurs at either the May or June FOMC meetings).

That overly large spread might propose that the eurodollar futures market viewing an accelerating economy and expecting imminent inflation is instead pricing for two more rate hikes rather than one (one at each forthcoming meeting between now and expiration). It would seem to fit the narrative currently in place of a booming domestic economy tied into globally synchronized growth. But even then, that leaves a little too much spread.

Leave A Comment