by Heli Brecailo

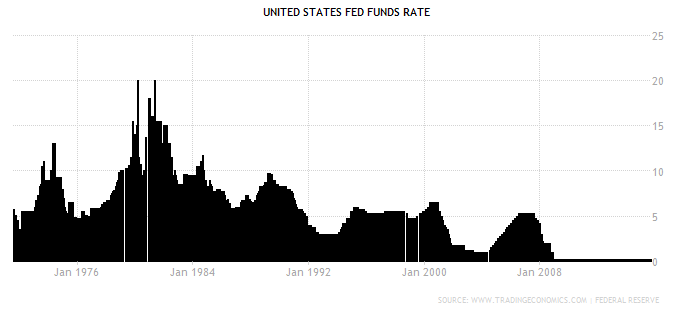

Clients have asked why there’s so much coverage of the Fed’s upcoming interest rate in the media. Apart from the usual buzz every time the Federal Reserve’s authorities get together for meetings, we are about to witness a historic moment. Fed authorities are gathering for the FOMC meeting on Wed 16 and Thu 17 to decide once again about interest rates. After seven years of no change, rates – which are presently stuck at 0.25 percent – could be increased. We haven’t seen a similar situation over the past several decades. This is the first time the Fed will begin a period of interest rate hikes in nearly a decade.

What puzzles investors this time and makes this potentially one of the most controversial rate hikes is the economics metrics. Our economy has certainly come a long way from the Great Recession of 2008-09. Nevertheless, this is not a fast-growing economy where demand is wildly outpacing supply across the board and creating inflationary pressures.

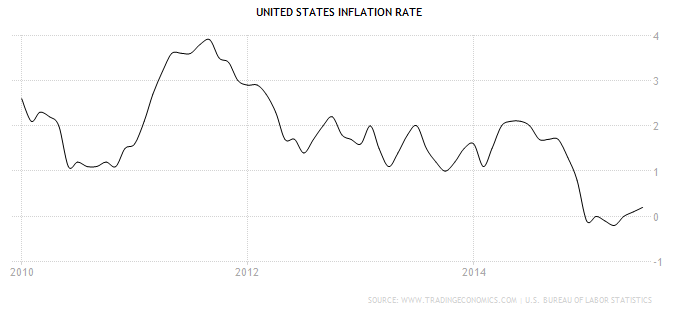

Indeed, rising inflation is one of the usual signs that a central bank will raise benchmark rates. This has worked as an instrument to discourage consumption and consequently reduce inflationary pressure. However, U.S. inflation has been at very low levels over the past five years. If the Fed were to increase rates, there would have been a stronger argument for it last year. This year, the U.S. has strolled past deflation boundaries.

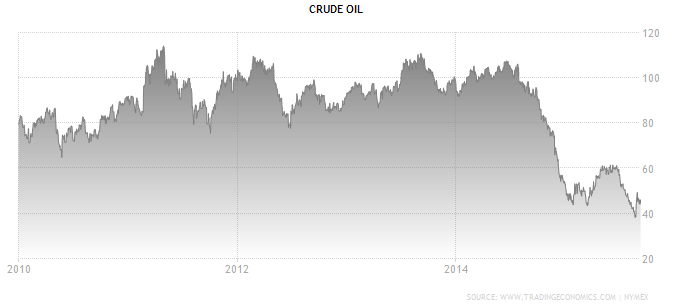

Oil prices, which have a significant influence on inflation, have declined and could continue to drop. A recurrent concern in the past has become quite the opposite. Although the relationship between oil prices and inflation no longer has the strength it did in the 1970’s, it remains an important indicator.

The strong dollar, which has dominated discussions in the second half of 2014 and first half of 2015, could also explain why inflation has been so tame lately. A strong dollar tends to restrain the economy by making exports more expensive and holding back growth while reducing the cost of imported goods. An important consequence is lower inflation pressure.

Leave A Comment