After three days of violent moves and sharp intraday reversals, in a week that feels far longer than just 4 days in, even equities appear exhausted today, and have entered the slow drift into the Easter break with volatility and volume far more subdued than earlier in the week courtesy of a slowdown in the newsflow, and as a result risk is once again bid, as it has been in the early part of most days this week… the question is will we get another late-day selloff.

Commenting on the recent risk moves, Deutsche Bank notes that markets seem to have spent the last 24 hours packing their bags and jetting off for the long weekend after an eventful last few weeks.

Aside from digesting a few more tech related stories, the lack of any material newsflow – the first time we can say that in a while – certainly seems to have helped. Indeed, by the end of trading last night the S&P 500 and Dow closed -0.29% and -0.04% respectively. The lack of any real direction throughout the session is best summed up by the fact that the S&P 500 passed between gains and losses by 37 times.

For some investors, especially the bulls, the coming holiday will be a relief following a roller coaster quarter in which stellar global equity gains gave way to a volatility blow up in February and a tech wreck. “We’ve done some damage with the correction and it’s going to take some time to repair,” Bob Doll, portfolio manager and chief equity strategist at Nuveen Asset Management, told Bloomberg TV. “Expect choppy, sideways volatility.”

The MSCI All-World Index of global stocks is set to end a 7-quarter winning streak – its longest such stretch of gains since 1997 – while global bonds are set for their first decline in currency neutral terms since 2016. The “melt-up” that sent the MSCI’s world share index up 8% in January has melted away, and now the Dow Jones, S&P 500, FTSE Nikkei and scores of other big markets are all down for the year.

“We have got to make sure (the market selloff) …is not too prolonged because the longer this goes the higher the chance it will start to affect the man on street,” said Head of Equities at London & Capital Roger Jones.

So heading into Easter weekend, European stocks are higher on Thursday after a mixed, if mostly higher session in Asia, as equity markets staggered toward the end of the most tumultuous quarter in years.

For the third consecutive day, S&P futures support at the 2,600 level, and we trading at session highs, 10 points higher than Wednesday’s close, around 2,618, while the VIX edged lower in early trading. “I think most of these markets are staring at the 200-day moving average on the S&P 500 to see if it breaks,” said Societe Generale’s Kit Juckes. As a reminder, the S&P 200DMA is at 2,588, so around 30 points lower.VIX

Europe’s Stoxx 600 Index headed for a 3rd day of gains as most major country bourses traded quietly in the green. Automakers led the move higher after Renault and Nissan Motor were reported to be in talks to merge. Defensive sectors were in the red with focus on utilities and healthcare whilst broad gains are seen across all the other sectors. Sodexo (-14.1%) was the laggard this morning after reporting its earnings, dragging down Elior (-1.0%) and Compass (-3.6%) in the UK food catering segment. SwissRE (+2.9%) is leading the SMI after Softbank is said to be interested in building a 25% stake in the Co. for a USD 9.6bln deal. TomTom suffered losses of 6.3% after approaching Deutsche Bank for a potential sale of the whole firm or minority stake but then denied calling for an adviser to seek potential buyers. Understandably, volumes were subdued, with many traders wrapping up ahead of a long weekend.

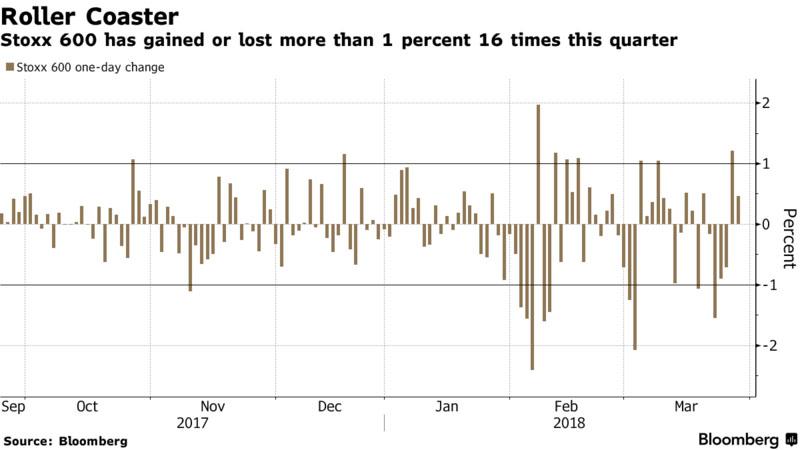

To be sure, the overnight quiet has been the exception lately, with the Stoxx 600 making gains or losses of more than 1% 16 times in the current quarter.

Earlier in Asia, equity markets traded indecisive as bourses failed to completely shrug-off the lacklustre lead from Wall Street. Helping the mood were media reports that Japan had sounded out North Korea’s government about a bilateral summit, and that Pyongyang had also discussed the possibility of a broader meeting with other global leaders. As a result, Japanese shares closed higher even as the yen retraced some of Wednesday’s slump, while stocks in China and Korea gained. ASX 200 (-0.5%) and Nikkei 225 (+0.6%) were mixed with Australia dragged lower by tech as well as recent weakness across commodities, while the Japanese benchmark was propped up for most the day by a softer currency. Elsewhere, Hang Seng (+0.2%) and Shanghai Comp. (+1.2%) were choppy in the midst of earnings season and with initial gains seen following reports of VAT reductions, although continued liquidity inaction by the PBoC and ongoing trade tensions with the US eventually weighed.

In overnight trade and tariff news, the China Ministry of Commerce said it hopes US drops unilateralism and protectionism, while it also hopes US takes steps and resolves conflict with China through dialogue. Furthermore, Mofcom added that US action on trade is like opening a Pandora’s box and that it sees spillover effects.

It was initially reported that US and are China in talks to shield soybeans from trade war, but this was later followed by conflicting overnight comments from the US Soybean Export Council that said China is still contemplating import curbs on US soybeans.

In FX, the dollar found support around fixing times, and after sliding earlier in the session is back to unchanged levels.

In a rather lackluster session, G-10 currencies remained confined to relatively tight ranges as traders await direction from tier-one data out of the U.S. due later Thursday. The USD/JPY holds close to 106.50 as yesterdays strong USD was unwound during Asian hours. A small pickup in activity into the Tokyo fix also saw EUR/USD and GBP/USD forced to session lows with most G-10 pairs then remaining in tight ranges.

Leave A Comment