Rule #1: Cash is King

If you remember one thing from Accounting 101, it should be: Cash is King. A company needs cash to make, market, or distribute its products.

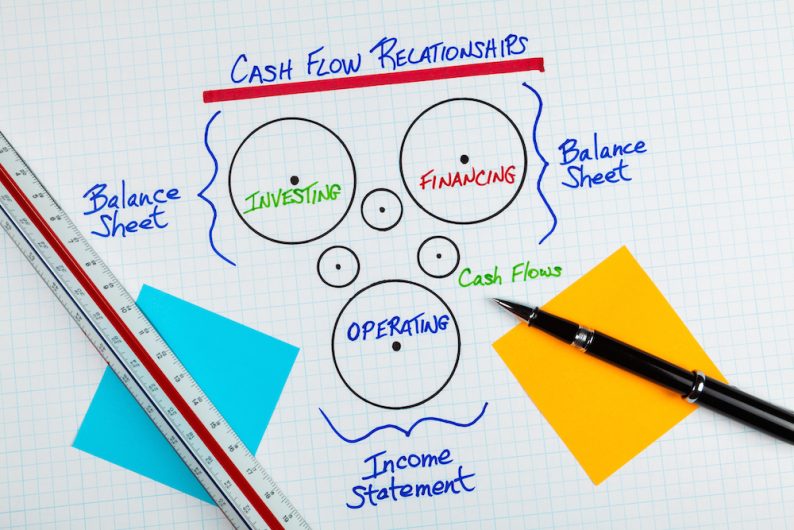

That’s why it’s important to understand the concept of Free Cash Flow or “FCF”. FCF represents the flow of cash coming IN to a business net of the cash going OUT. In more technical terms, FCF is NOPAT minus this year’s increase (or decrease) in Invested Capital.

Rule #2: Cash may be King, but FCF yield is an Ace

Free Cash Flow is an important tool, but the level of FCF can be deceiving. A high FCF could mean that a company is incredibly profitable or that it has limited growth opportunities (i.e. limited investments for cash). On the other hand, a negative FCF could stem from poor management decisions or from investment in high growth opportunities (i.e. more investments than cash on hand).

We need a metric that provides some context. FCF yield is the answer: the ratio of Free Cash Flow to a company’s enterprise value.

FCF yield is a measure used to estimate the rate of return of a stock by comparing a company’s free cash flow to its overall value.

Rule #3: FCF yields > P/E multiples

Although they are beloved by the financial media, P/E multiples (price-to-earnings multiples) tell us little about a company. They are an oversimplified metric used to quickly estimate future performance.

FCF yield is an accurate measure of future company and stock performance because it is derived from two calculated accurate values: free cash flow and enterprise value.

Take the case of Amazon (AMZN). In 2013, Amazon was regularly posting a P/E multiple in the 500s; however, it was at the same time yielding a negative FCF yield. While the P/E multiple gives us little information on AMZN’s future, the negative FCF yield is more telling.

In order to sustain its various business operations, Amazon must invest higher rates of its profits back into its business. AMZN lost 15% of its share value over six months and almost 30% of its value over ten months.

Leave A Comment