One week ago, we wrote that as a result of the collapsing crude contango, oil tankers (such as the fully loaded Distya Akula which has been on anchor in the Suez Canal for one month unable to find a buyer for its cargo so it continues to wait) “will soon have to unload their cargo”, in the process flooding the already oversupplied market with millions of barrels of crude oil, thus pushing the price of oil far lower. But how many millions of barrels, and how much lower will the price of oil go?

For the answer we go to Deutsche Bank’s Michael Huseh, who has done the calculations to get the answer.

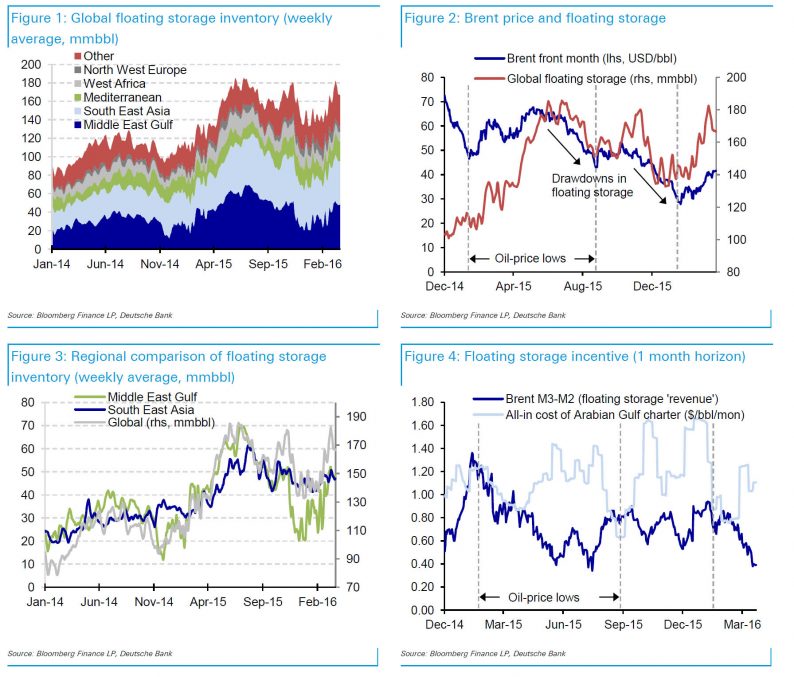

What he finds is that since the start of 2014, global floating storage inventory has ranged between 80 and 180 million barrels (Figure 1). According to estimates of the global VLCC fleet at the end of 2014, the potential storage capacity is implied to be 1169 million barrels. Adding Suezmaxvessels would add 528 million barrels of capacity.

After touching 186 million barrels in early March, inventories have begun to decline once more. Since the start of 2015, one can identify both periods when builds in floating storage have been associated with rising Brent prices, and also periods when draws in floating storage have been associated with falling Brent prices (Figure 2). Since the Arabian Gulf has represented much of the variability in floating storage inventory, one can also measure the incentives to add or withdraw from storage using Arabian Gulf tanker rates.

South East Asia would be another valid candidate to measure economics, as floating storage inventories in that region have moved in a very similar fashion (Figure 3).

As we discussed recently, as a result of a recent surge in hedging activity in the front-end of the strip, absent a dramatic collapse in spot prices, the contango is now so low as to make offshore storage no longer economical. Specifically, based on the all-in cost of operating tanker storage (dirty VLCC tanker day rates, financing, transit and transfer loss, insurance and bunkers, Figure 5), the current storage cost is too high relative to the steepness of the Brent forward curve. This means that prices do not justify inventory build, but rather gradual inventory drawdown as existing storage trades are unwound.

Leave A Comment