Darden Restaurants, Inc. (DRI) Consumer Discretionary – Hotels, Restaurants & Leisure | Reports December 18, Before Market Opens

Key Takeaways

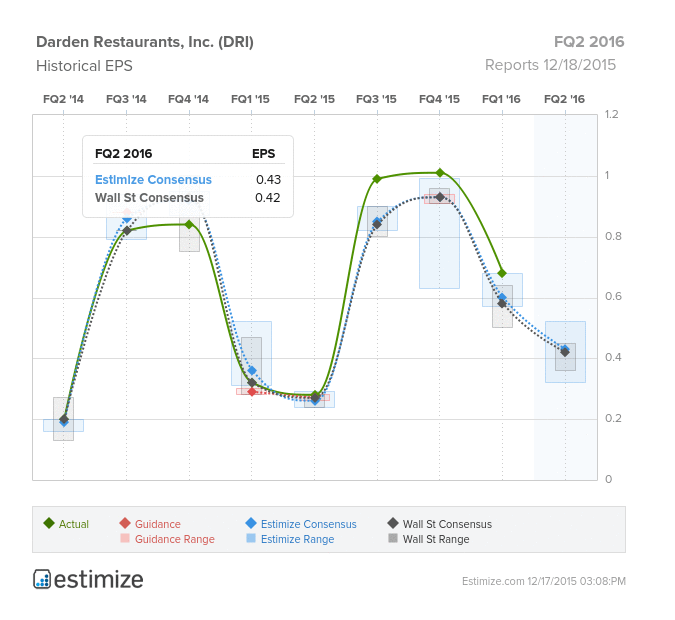

Best known for its breadsticks at Olive Garden, Darden Restaurants is a premier full service company operating leading chains around the United States. Given how much fast-casual has cannibalized the casual dining experience, Darden Restaurants has performed remarkably well, beating analysts estimates the past 4 quarters. In that time, the restaurant group has undertaken a significant overhaul of menus, marketing, digital advertising and customer services in many of their most popular restaurants. This makeover has come to the pleasure of shareholders, yielding positive results and profitability. With the last four quarters being favorable, the Estimize consensus calls for revenue and EPS of $1.629 billion and $0.42 respectively coming into their FQ2 2016 earnings. This reflects a year over year increase of 65% in EPS and 4.4% in revenue. With that said, expectations are that Darden will continue its positive momentum for the remainder of the fiscal year.

Following a disappointing fiscal 2014, Darden Restaurants implemented a strategic plan to overhaul all restaurant operations. Activist hedge fund, Starboard Value, facilitated an increase in sales, same store growth, and overall profitability in Darden Restaurants. Their flagship, Olive Garden restaurants, successfully underwent a renaissance plan encompassing simplifying kitchen systems, developing core menu items, updating the online platform and revamping the restaurant’s design. The other main change led by Starboard was the spin off of 430 restaurant properties into a REIT. With a strategic plan in action, investors can consider Darden Restaurants for dividends and growth going into their earnings report.

Leave A Comment