Photo Credit: Martin Frey

Pandora Media, Inc. (P) Information Technology – Internet, Software & Services | Reports October 25, After Market Closes

Key Takeaway

Pandora is scheduled to release its third quarter results this Tuesday after the market closes. The online streaming service has been on the wrong side of earnings for over a year. Both revenue and earnings growth has decelerated each quarter as a number of new services emerge in the music industry. Spotify currently holds the top spot in the space with Pandora, Apple, and Amazon not far behind. For these reasons, expectations have drawn down heading into the upcoming report.

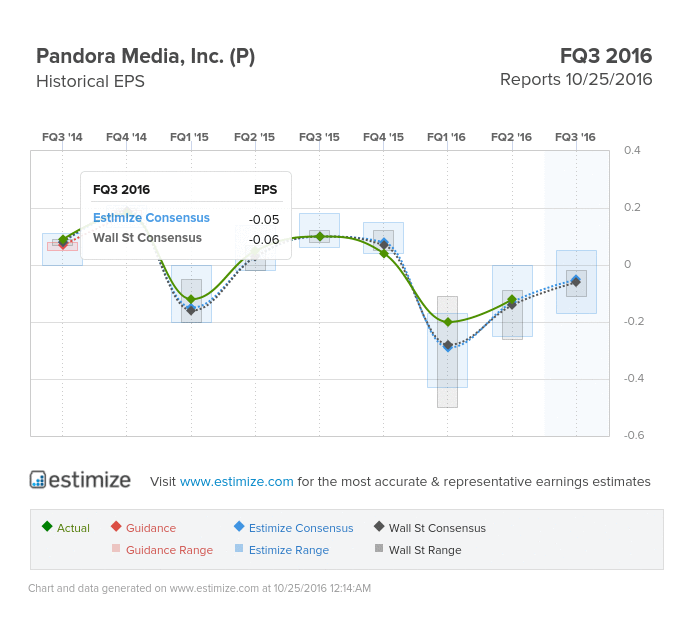

Analysts surveyed at Estimize are calling for a 5 cent loss, reflecting a 154% drop from a year earlier. That estimate was even lower 3 months ago after Pandora’s most recent report. Revenue for the period is anticipated to grow by 18% to $366.06 million, extending the pronounced slowdown on the top line. Naturally, weak earnings reports would translate to tumbling stock prices. Shares are down 5% year to date and typically fall immediately following an earnings report.

Over the past few years, Pandora has lost its dominant position in the online radio market which now features a new leader in Spotify. Just behind Pandora and Spotify are tech giants Amazon and Apple who both have the resources to over take the top position in the industry. Meanwhile, rising costs related to music licensing and expansions will continue to take its toll on profitability. Pandora is headed for its third consecutive quarter of posting a loss and the first with under 20% revenue growth. These dynamics are unique to today’s music streaming market and will likely lead to a weaker earnings report.

Leave A Comment