Workday Inc. (WDAY – Free Report) reported third-quarter fiscal 2018 non-GAAP earnings of 24 cents per share, which beat the Zacks Consensus Estimate of 15 cents. The figure was also better than 5 cents reported in the year-ago quarter.

The strong growth was primarily attributed to 34.3% jump in revenues, which totaled $555.4 million. The figure surpassed the guidance of $538-$540 million and beat the Zacks Consensus Estimate for revenues of $540 million. The robust top-line performance was driven by solid growth in subscription and professional revenues.

Subscription revenues (82.7% of total revenues) soared 37.2% year over year to $463.6 million, driven by expanding customer base. The figure surpassed the guidance of $450-$452 million. Annual customer satisfaction rating was 98%, which was better than management’s target of 95%.

Professional services revenues (17.3% of total revenues) grew 21.4% from the year-ago quarter to $91.8 million and were better than the guidance of $88 million.

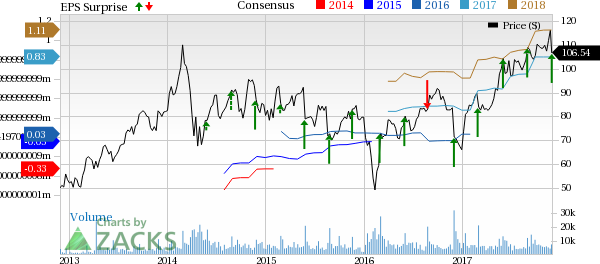

Workday, Inc. Price, Consensus and EPS Surprise

Workday, Inc. Price, Consensus and EPS Surprise | Workday, Inc. Quote

Revenues outside the United States surged 48% to $116 million, representing a record 21% of total revenues in the quarter.

Shares fell 5.2% during after hour trading. Workday’s shares have gained 62.3% year to date, substantially outperforming the industry’s 18.1% rally.

Customer Addition Continues

During the quarter, companies like Lowe’s Corporation, M&T Bank Corporation, Lloyds Bank plc, Software AG and Oshkosh Corporation selected Workday’s HCM solution. Moreover, Dell USA, Coca-Cola Company and Cerner Corporation went live.

Workday added 37 financial management customers, up more than 60% from the year-ago quarter. The clientele now includes Sanford Health, University of Louisiana and Melco Resort Services.

Further, the company won 34 planning customers. Total planning customers on Workday’s platform totals more than 200.

Leave A Comment