WTI Crude Oil

The WTI Crude Oil market tried to rally during the session on Wednesday, reaching towards the $55 level. The area caused enough resistance to turn the market around and form a bit of a shooting star. A breakdown below the bottom of the shooting star should send this market looking for the $53 level, which was massive resistance, but should also be supportive. Because of this, I think we’re going to get a bit of a short-term selloff, but I think that the buyers will probably return and this area, and that I think that the market breaking down below there would be very bearish, perhaps sending us to the $50 handle. There are a lot of mitigating factors right now, but the easiest thing to come to terms with is that the market is overextended, so a pullback makes perfect sense. If we do break above the top of the candle for the session on Wednesday, it would become a very impulsive and bullish move.

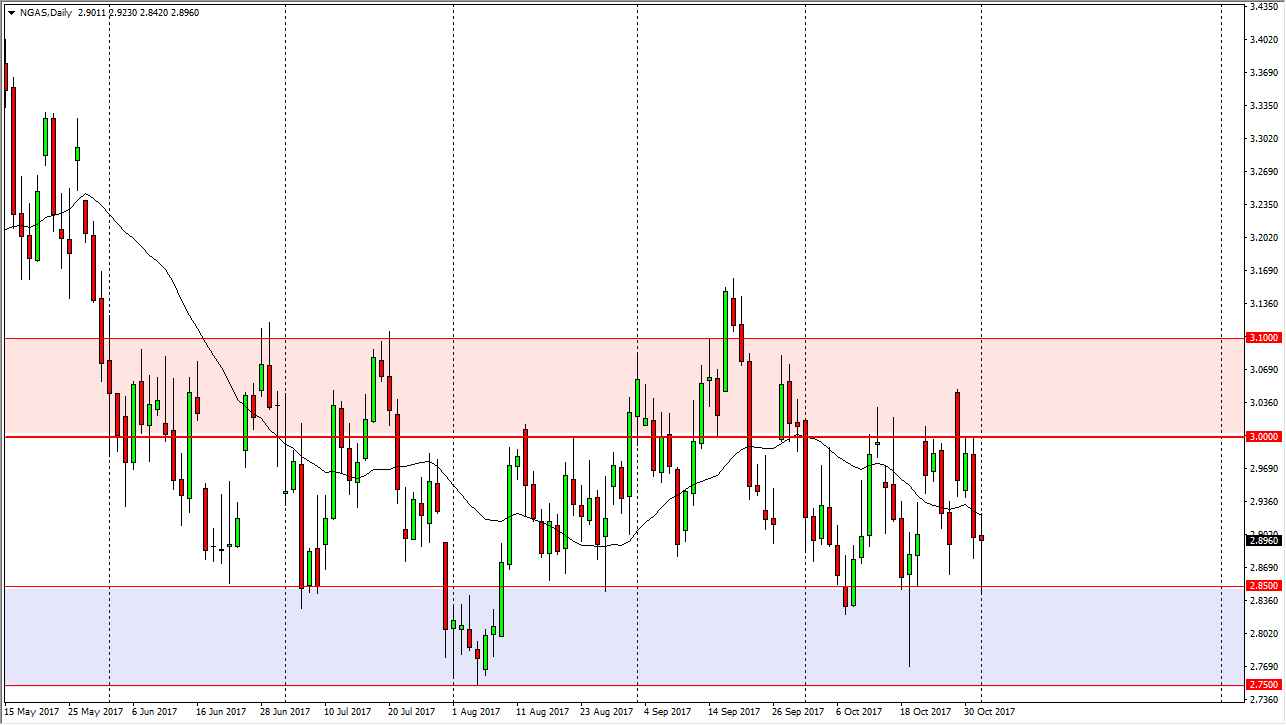

Natural Gas

The natural gas markets initially fell during the trading session on Wednesday but bounced from the 2.85 level to show signs of support and form a hammer. As you can see on the daily chart, I have a “buy zone”, and a “sell zone” marked by a light red and then a purple rectangle respectively. We are currently looking likely to rally from here, but I think this is short term as the overall consolidation should continue. The market is going to deal with oversupply every time we get to the $3 handle, because quite frankly US franking companies are up to their ears in natural gas. Because of this, I think range bound traders are going to continue to do quite well in this market.

Leave A Comment