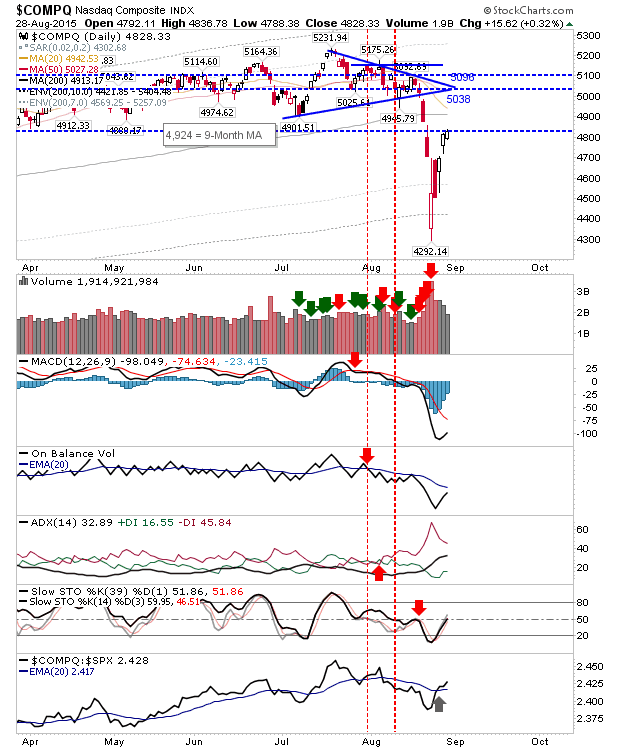

The interconnectedness of global markets is a boon and a bane to investors. The week began with what was dubbed Black Monday, although this spurious connection to the infamous 1987 Black Monday is anything but accurate. On that day, Wall

August 30, 2015