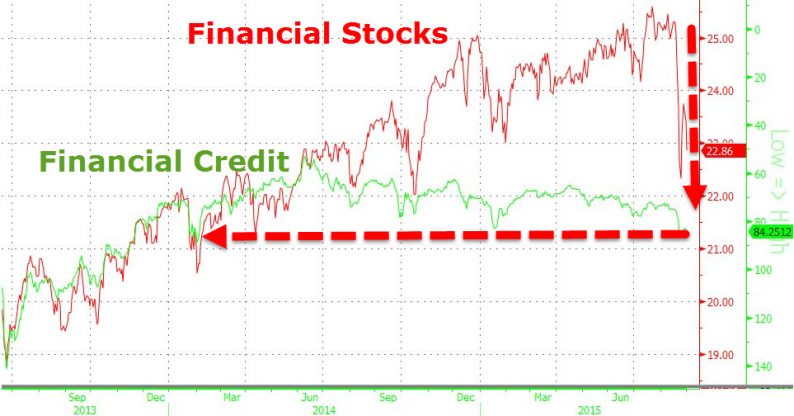

Global markets took a beating today. The Shanghai Composite was only down 1.28%, but the Nikkei dropped 3.84%. The Euro STOXX 50 lost 2.47%. Our benchmark S&P 500 plunged at the open, drifted sideways until late morning and then sold

September 1, 2015

Last week, three different measures of consumer confidence came out: University of Michigan: Consumer Sentiment Conference Board: Consumer Confidence Level Gallup: Economic Confidence Index Claim of Importance Bloomberg states “Consumer sentiment is directly related to the strength of consumer spending.”