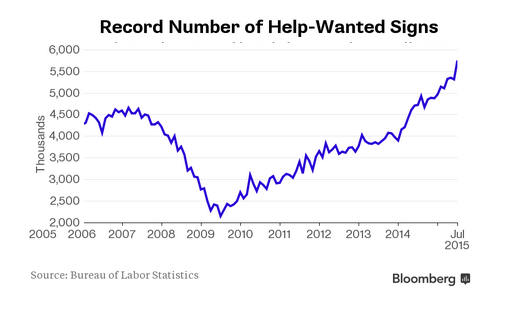

Strong Employment Data The Federal Reserve has a dual mandate (employment and inflation). With the unemployment rate hovering near the Fed’s stated level of full employment, it is getting harder and harder to justify keeping rates at “the world is

September 9, 2015