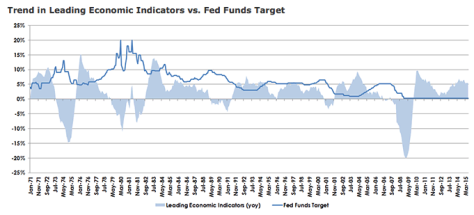

Before I show why they have been wrong, I am going to cite some celebrated economic pundits who said that the long bonds would go up in yield after QE. After all, they thought they had it right. And you

September 14, 2015

Investors frequently diversify their portfolios between stocks, bonds, and cash, between different sectors of the economy, and geographically. However, an important but often overlooked type of diversification is active and passive management. Active management “Active management” means the investor actively