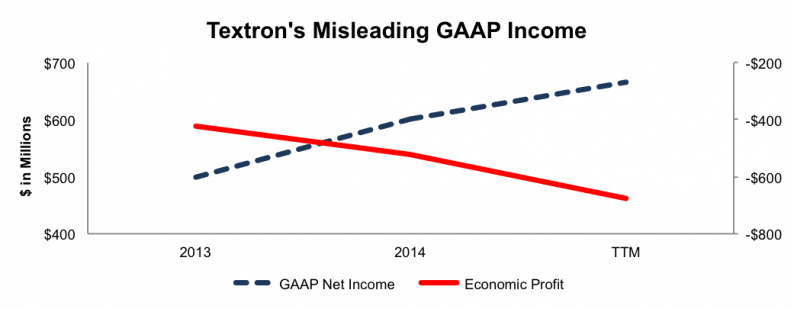

From non-GAAP accounting to costly acquisitions, it is not difficult for a company to create the illusion of profits. However, eventually reality sets in and the deterioration of a business comes to light. This week’s Danger Zone pick, Textron Inc.

November 23, 2015