Despite a ceaseless propaganda campaign declaring all is well with the U.S. economy, the Status Quo is fragile–and voters know it. Not only do they know the economy–and their financial security–is one crisis away from meltdown, they’re also fed up with

December 8, 2015

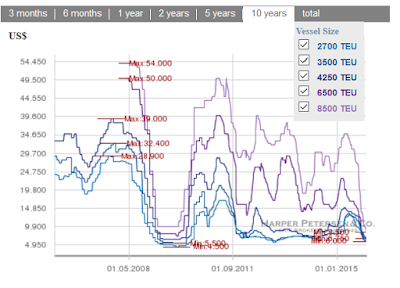

The following charts show what happens when an increasing number of ships meets falling demand. Harper Petersen Shipping Rates by Vessel Size – Ten Years image: http://4.bp.blogspot.com/-NeQn5KKa5pw/VmdF03IIrFI/AAAAAAAAgfY/gdbzBSVawug/s400/Harper%2BPetersen%2B2015-12-08A.png Source: More charts below, but first let’s explain TEU. TEU stands for twenty-foot-equivalent