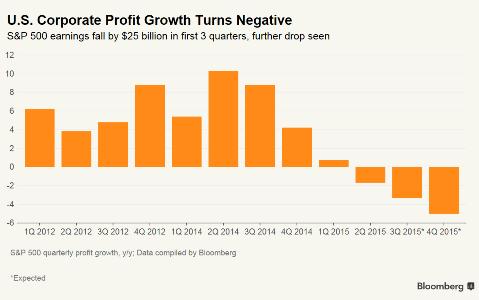

The graph below belongs in the “what where they thinking category”. After Tuesday’s dividend massacre, it plain as day that Kinder Morgan (KMI) wasn’t the greatest thing since slice bread after all. That is, a “growth” business paying rich dividends out of rock solid profit margins

December 10, 2015