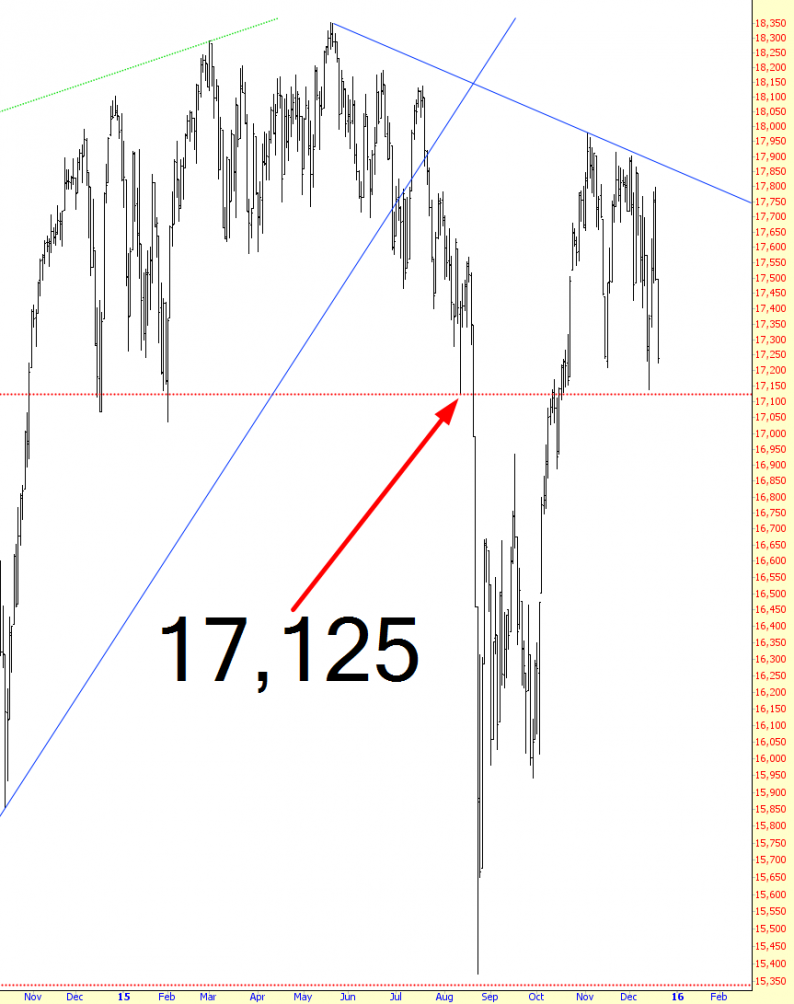

Winter’s coming. OK, not really. Winter’s already here. But, for the investing world, things are starting to get a lot more chilly and scary. The storm clouds are rolling in. After seven years of holding short-term interest rates at roughly

December 18, 2015