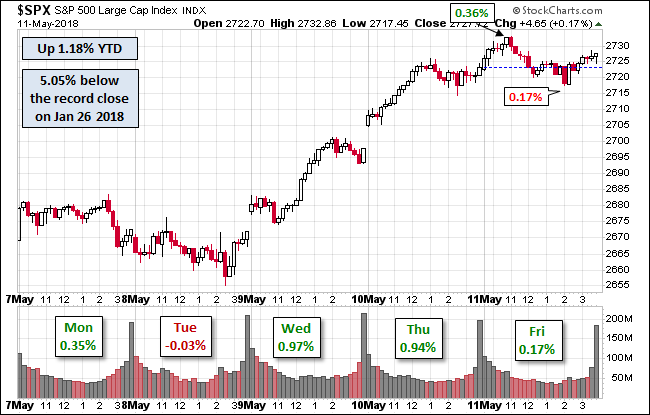

U.S. equities traded nicely higher amid a backdrop of some mixed economic and equity news, while volume remained on the lighter side as investors look ahead to the Christmas holiday break. Treasuries were lower in the wake of a slight

December 22, 2015