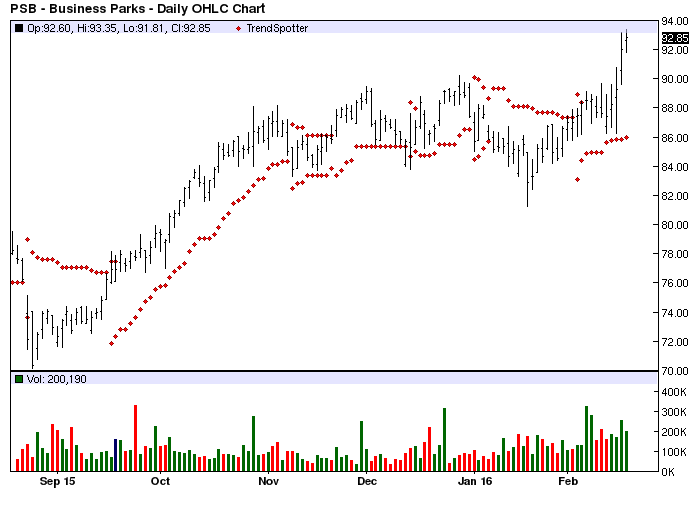

The Chart of the Day belongs to PS Business Parks (NYSE:PSB). I found the REIT by using Barchart to sort the All Time High list first for the highest technical support level then I used the Flipchart feature to review the charts. Since the Trend Spotter

February 18, 2016